Daily Derivatives Report 06th October 2025 by Axis Securities Ltd

The Day That Was:

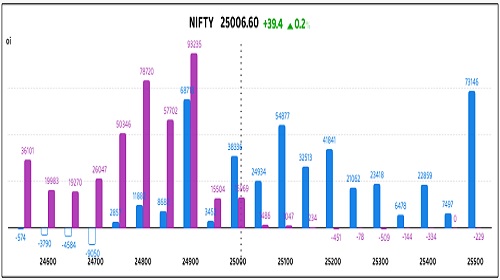

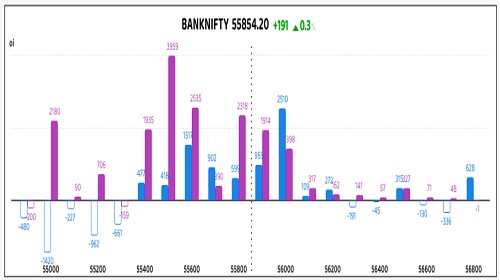

Nifty Futures: 25,006.6 (0.2%), Bank Nifty Futures: 55,854.2 (0.3%).

Nifty and Bank Nifty futures capped a positive week by extending their rally for a second straight session on Friday, as investor sentiment remained buoyed by the Reserve Bank of India's supportive policies and favourable global cues. Nifty Futures rose 39.4 points, and this price gain was backed by a significant 4.3% (or 8 Lc shares) addition to open interest, confirming a clear Long Build Up despite the premium contracting to 112 points. Similarly, the 191-point surge in Bank Nifty Futures confirmed a robust Long Build Up, supported by a 1.9% (or 40,250 share) increase in open interest, even as its premium narrowed to 265 points. This bullish market sentiment was further echoed by a 2.2% drop in the India VIX to 10.06, signalling reduced market fear. Sectoral activity saw advances in Metal, PSU Bank, and Consumer Durable shares, while Realty and Auto stocks declined. Meanwhile, the Indian Rupee closed near its all-time low at ~Rs 88.77 against the US Dollar.

Global Movers:

US stocks ended higher, but not before erasing earlier gains as tech stocks sold off. The S&P 500 finished flat at 6716 while the Nasdaq 100 dropped 0.4%. Bullish sentiment continues to prevail overall as equity ETFs received inflows of $152 billion in the past three weeks -- the highest ever -- even as valuation concerns persist. In related markets, the VIX rose for a fifth straight day, the dollar fell and the US 10-year treasury yield gained a little. Elsewhere, Gold settled at a record of $3887/ounce, ending higher for a 7th straight week, as the US government shutdown created more uncertainty for investors and acted as yet another tailwind for the yellow metal. Meanwhile, Brent finished up 0.7% for the first time in five days as Ukraine claimed a strike on one of Russia's largest oil refineries.

Stock Futures:

Kalyan Jewellers India Ltd. (KALYANKJIL) surged, driven by highly positive company-specific news and potent sectoral tailwinds, with the momentum amplified by a local brokerage's upgrade to a 'Buy' rating, which cited a significant margin of safety after a prior correction and forecasted robust sales growth fuelled by the festive and wedding season. The stock's 5.4% price gain was underscored by a Short Covering in the derivatives segment, evidenced by a 1.8% decrease in open interest, shedding 469 contracts to bring current futures open interest to 25,741 contracts. Option positioning revealed a bullish tilt as total open interest in call options reached 9,241 contracts against 5,611 in put options; however, the addition of 1,052 put contracts outpaced the 286 added call contracts, even as the Put-Call Ratio (PCR) climbed from 0.51 to 0.61. The derivative structure suggests a short-term pause in the upward trajectory, as aggressive put writing signals strong support, while significant open interest in calls suggests a ceiling for the rally.

Tata Steel Ltd. (TATASTEEL) witnessed a robust rally, with the stock price surging to touch a new 52−week high, galvanised by a wave of strong buying across the entire metals and mining space, propelling the Nifty Metal index to emerge as the day's top sectoral gainer. This upward swing was sustained by a strong domestic demand outlook and projections of sustained growth in steel consumption, underpinned by government-led infrastructure spending. The 3.4% price gain was characterised by a Long Addition in futures, with open interest spiking 3.2%, resulting in 1,061 new contracts, bringing the total futures open interest to 33,762 contracts. Option data reflects pronounced bullish anticipation, with 15,333 total call contracts overwhelming 11,386 put contracts; significantly, the addition of 2,938 call contracts narrowly surpassed the 2,752 put contracts, causing the Put-Call Ratio (PCR) to edge up from 0.70 to 0.74. The derivatives analysis indicates strong conviction among option buyers betting on higher prices, juxtaposed with intense writing on the put side, signalling firm belief in the current price floor.

Max Healthcare experienced a notable downturn, extending a negative trend observed since reaching its 52−week high in Jul’25, with the significant one-day drop attributed to post-inclusion volatility and a major bulk deal involving institutional selling. The stock's 4% price decrease precipitated a Short Addition event, as open interest swelled 4.3%, absorbing 1,489 new contracts to settle the current futures open interest at 35,795 contracts. Futures closed at a 10.8-point premium to the spot price, a modest 0.9-point decrease from the prior session's 11.7-point premium. Option positioning revealed 9,416 total call contracts, substantially exceeding 4,695 total put contracts; this bearish sentiment was further cemented by the massive addition of 5,092 call contracts, dwarfing the 2,318 put contracts added. The derivatives data signify a firm bearish sentiment, as aggressive call buying combined with the high call open interest suggests significant resistance at higher price levels, confirming the downward pressure.

Lodha Developers witnessed a significant decline, participating in a broader bearish trend for the stock as the real estate sector faced concerns over sluggish demand and profit-taking following a substantial rally, which weighed on the Nifty Realty index. Compounding this pressure was company-specific news regarding a former director, Rajendra Lodha, being booked by the police over alleged land deal irregularities, creating an overhang of corporate governance/legal concern. The 2.4% price decrease led to a Short Addition, with open interest skyrocketing 6.7%, absorbing 1,462 new contracts and bringing the current futures open interest to 23,252 contracts. Option positioning saw total call open interest at 5,340 contracts, overwhelming 2,593 total put contracts, though the 3,166 contracts added to calls dramatically outpaced the 837 put contracts added, and the Put-Call Ratio (PCR) plunged from 0.81 to 0.49. The option metrics indicate powerful bearish conviction, driven by aggressive call buyers and a sharp drop in the PCR, pointing toward the expectation of further price erosion.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 1.17 from 1.18 points, while the Bank Nifty PCR rose from 1.13 to 1.15 points.

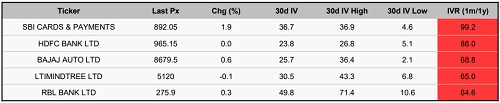

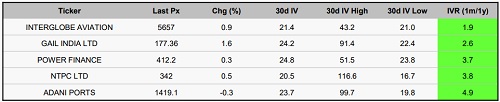

Implied Volatility:

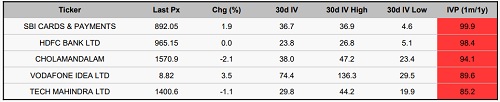

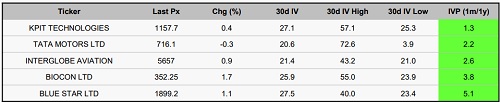

SBI Cards & Payments and HDFC Bank are currently experiencing a period of elevated volatility. This is evidenced by their high Implied Volatility (IV) rankings of 99% and 86%, respectively, a sentiment robustly supported by Realized Volatility (RV) figures of 37% and 24%. This market perception of substantial future price dispersion has led to inflated option premiums. Consequently, the cost for both hedging and speculative exposures is heightened, making these strategies significantly more capital-intensive. Conversely, Interglobe Aviation and Adani Ports are situated within a low-volatility regime relative to the peer group. Their subdued IV rankings of 21% and 24% have resulted in a marked compression in option premiums. This environment establishes a more favourable risk-reward profile for executing directional plays via long Call or Put positions due to the lower initial outlay. Furthermore, the stable price action enhances the feasibility of premium-harvesting strategies. The higher probability of options expiring Out-of-the-Money (OTM) allows sellers to more effectively capture theta decay and retain the collected premium.

Options volume and Open Interest highlights:

United Spirits and Hindustan Aeronautics (HAL) are exhibiting a constructive outlook in the options market, evidenced by their highly elevated Call-to-Put Volume Ratios of 5:1 and 4:1, respectively. This pronounced skew toward call option activity signifies heightened bullish sentiment, suggesting that investors are aggressively positioning for potential upside in these underlying equities. The resultant surge in call demand has driven an uptick in option premiums, consequently increasing the cost of initiating new long exposure through the derivatives segment. Eicher Motors and Max Healthcare are currently reflecting a bearish sentiment bias, characterized by elevated Put-to-Call Ratios. This implies a higher volume of outstanding put contracts relative to calls, which is generally associated with downside hedging or speculative short positioning. However, the concentrated build-up of bearish bets could also indicate that these counters are approaching oversold territory, potentially creating contrarian entry points for value-oriented investors. MAXHEALTH and Tata Motors currently present a mixed derivative setup with a subtle bullish undertone. The simultaneous rise in Open Interest (OI) across both call and put strikes suggests expectations of heightened near-term volatility, although directional clarity remains elusive. This positioning implies that market participants are preparing for a significant price move, albeit without a clear directional bias. RBL Bank is witnessing increased traction on the call side, suggesting positive directional sentiment with potential upside expectations or possibly significant call writing activity. REC Ltd is experiencing a build-up in put option OI, indicative of a more cautious stance among traders. While directional conviction appears limited, the accumulation of protective puts reflects market concerns regarding short-term volatility and downside risk. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, the aggregate change of 12,586 contracts was predominantly driven by a substantial net addition of 9,361 contracts by Clients, indicating a significantly bullish retail-investor sentiment, which starkly contrasted with the massive net reduction of 12,586 contracts by Foreign Institutional Investors (FIIs), signaling a pronounced bearish stance and profit-taking or risk aversion; simultaneously, Proprietary traders exhibited a cautiously optimistic bias with a modest accumulation of 3,016 contracts. Conversely, the overall shift of 40,584 contracts in stock futures saw Clients making an overwhelming bullish contribution of 33,137 contracts, establishing a considerable positive outlook in specific equities, while both FIIs and Proprietary traders mirrored a decided lack of conviction, recording significant net decreases of 28,664 and 11,920 contracts, respectively, collectively suggesting professional caution or bearish hedging against individual stock volatility.

Securities in Ban for Trade Date 06-October-2025:

1. RBLBANK

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Daily Technical Outlook by Axis Securities Ltd