Crude Compass - Weekly Oil Market Dossier by Choice Institutional Equities

Developments over the past week:

* Saudi Aramco lowered the official selling price of its flagship Arab Light grade for Asian buyers for the month of December 2025. The premium of Arab Light grade has been reduced from USD 2.2/b to USD 1/b against Dubai crude.

* In a significant change in its stance, IEA informed that global demand would continue to rise to 113 million barrels per day (mbd) through 2050, as compared to its earlier predictions of demand peaking over the next few years. The agency reiterated that India would continue to drive growth in global oil demand, with India’s oil consumption rising from 5.5 mbd in 2024 to 8.0 mbd in 2035.

* Oil prices, as per market reports, could decline to levels of USD 30-40/b if Venezuelan crude returns to global supply landscape. Prior to underinvestment by the current administration, Venezuela exported ~2.5 mbd.

In our opinion:

* We do not foresee oil prices slipping to USD 30–40/b in the medium-term. As Venezuelan crude is among the heaviest globally, it can only be processed by select refineries, resulting in mild pressure on prices.

* Simultaneously, efforts by major producers to protect or regain their market share will keep oil prices subdued for an extended period. On account of this, Indian refiners' margin stands to expand, at least through Q1 FY27.

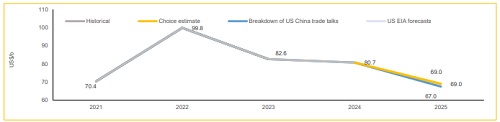

We maintain our Brent estimate of USD 69.0/barrel (b) for the Calendar Year 2025 (as published on June 13th, 2025), as compared to YTD average of USD 68.9/b. We estimate the Brent to average at USD65.0/b in CY26.

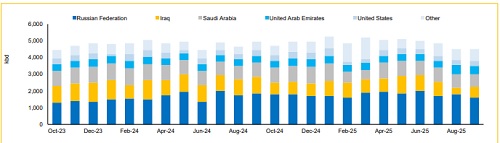

Exhibit 1: India’ oil import Break-up

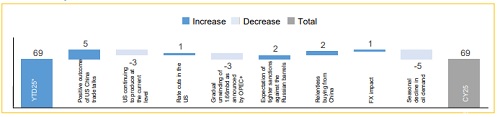

Exhibit 2: Catalysts for Brent

Exhibit 3: Brent estimates

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)