Crude Compass - Weekly Oil Market Dossier by Choice Broking Ltd

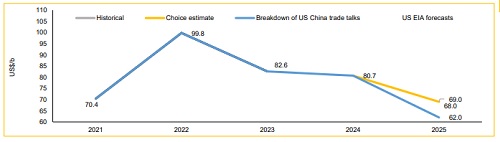

We maintain our estimate for Brent at US$69.0/b for the Calendar Year 2025 (as published on June 13, 2025) compared to YTD average of US$69.6/b..

We continue to believe that Brent prices will be driven by the following aspects over the short-term:

* Increasing pressure against imports of Russian barrels: In a scenario of Russian barrels getting completely displaced from the market, the oil prices may edge up. However, in our opinion, this is less likely to take place.

* Actual increase in output from OPEC+: Although there is announcement of 130kbd increase for the month of November, the actual output have been differing from prior announcements.

* Increased crude oil imports by China: As per market reports, the difference between the refinery runs and oil imports suggest that there is aggressive build up of crude oil storage by China and it may continue over the next year.

In the meantime, the Indian imports from Russia does not seem to decrease although the talks with US are ongoing regarding the reduction in tariffs. The discount of Urals to Brent remains key parameter for India to continue buying Russian oil. In case the pressure further intensifies, we see the discount widening which may propel the GRMs higher.

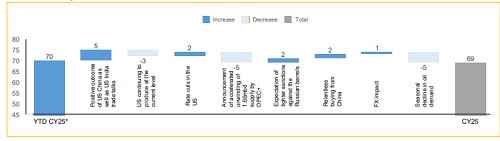

Exhibit 1: Catalysts for Brent

Exhibit 2: Brent estimates

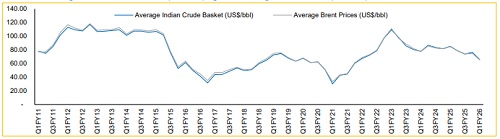

Exhibit 3: Average Indian Crude Basket (US$/bbl) against Average Brent Prices (US$/bbl)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131