Commodity Morning Insights 20th August 2025 - Axis Securities Ltd

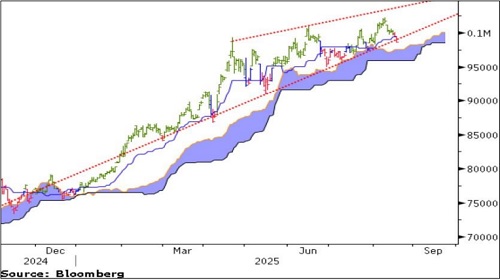

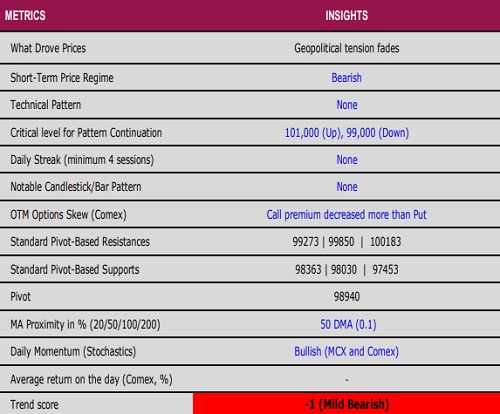

* Comex Gold settled lower in the previous session, declining by over 0.5% as the strength in the dollar index weighed on sentiment. Profit booking emerged in the domestic market near record highs, reducing the appeal of precious metals. Market participants are now awaiting cues from the Federal Reserve’s Jackson Hole symposium, while the release of the latest FOMC meeting minutes later in the day is expected to offer further policy direction

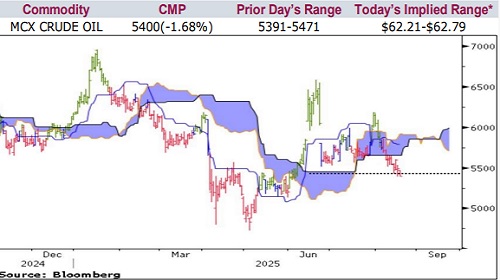

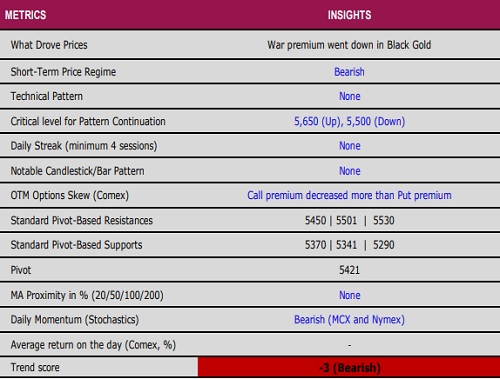

* Nymex Crude Oil also moved lower by nearly 1%, pressured by optimism over a potential resolution to the Ukraine-Russia conflict. Additional weakness stemmed from expectations of higher OPEC+ output starting from next month and the rebound in the dollar index, which together kept crude prices under sustained pressure

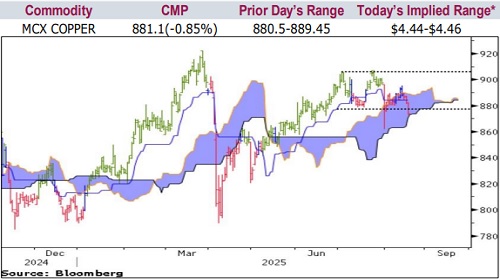

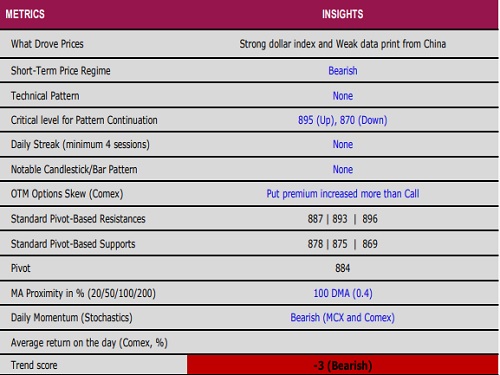

* LME Copper slipped in the last session as lacklustre Chinese economic data, combined with a stronger dollar and the absence of fresh triggers, prompted profit booking in the base metals complex

* Nymex Natural Gas dropped sharply by close to 5%, touching a nine-month low as forecasts turned colder, signalling weaker late-summer demand. Elevated production levels have kept inventories well above average, adding further downside pressure on prices

Gold

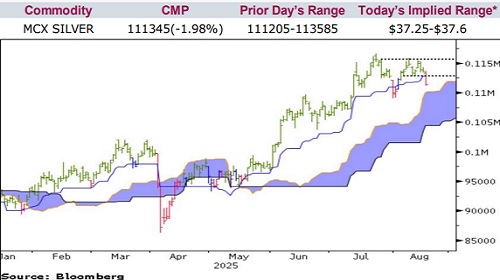

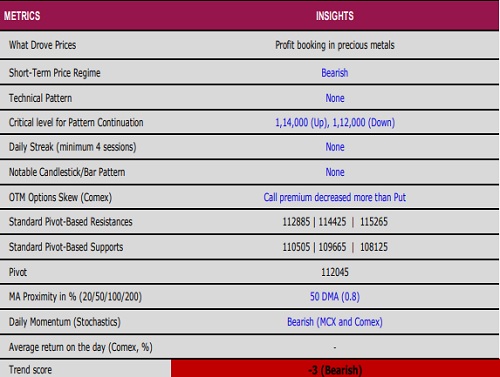

Silver

Crude Oil

Copper

.

.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633