CPI Inflation : Series low hit; FY26E now sub-2% by Emkay Global Financial Services Ltd

October headline inflation hit a series low of 0.25%, driven by a favorable base effect, continued easing in food prices, and the GST rejig. Notably, Sep CPI was revised downward (1.4% vs 1.5% earlier), possibly reflecting some of the GST impact. Several major GST-affected categories did not show full transmission in Oct which implies further spillover into Nov. Core CPI dipped slightly to 4.4% (vs revised Sep print of 4.5%); the gold price surge (~12% MoM) offset the partial GST gains. Core ex-gold dipped to 3.3%. Nov CPI is currently tracking 0.9%, with a downside due to GST spillover. FY26E headline CPI is now <2%, implying further downside of ~50bps to RBI’s forecast of 2.6%. This could support the case for a Dec rate-cut (and beyond, depending on how the tariff scenario evolves). We reiterate that given the repeated undershoots versus RBI’s inflation forecasts, the policy focus on one-year-ahead inflation forecast (RBI: 4%+) looks increasingly misplaced in a fast-changing environment.

Headline CPI hits a series low of 0.25%, with only partial GST transmission

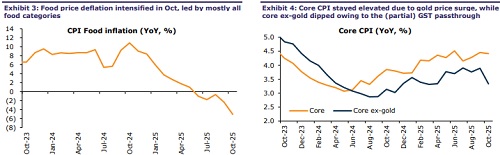

Headline CPI inflation declined to a series low of 0.25% in Oct-25, in line with estimates (Emkay: 0.28%, prior: 1.44%). Notably, Sep-25 CPI has been revised down (earlier: 1.54%), possibly reflecting some of the GST rejig impact. We note that several major categories affected by the GST changes did not show full pass-through in Oct (nonalcoholic beverages, prepared meals, HH goods and services, health, personal care, tobacco, and intoxicants), with transport and communication (ie autos) the only category where near-complete transmission was seen. Headline CPI rose 0.2% on the month (vs 0% prior). The key drivers for the Oct-25 print were a favorable base effect and continued sequential easing in food prices (-0.3% MoM; -5% YoY), along with the impact of the GST rejig. Within food, nearly all categories saw declining prices on the month, owing to seasonal factors and the GST changes.

Core inflation dips slightly; gold surge offsets the partial GST gains

Core inflation (ex-intoxicants) dipped to 4.4% (vs 4.5% prior), with the Sep-25 print revised down from 4.7% earlier, largely led by Housing (Sep final: -0.2% MoM vs 0.8% earlier). Monthly momentum rose slightly to 0.5% (vs 0.4% prior). A surge in gold prices (12% MoM, 58% YoY) was once again the primary driver of core inflation, with the Personal Care category rising 5.7% MoM as a result, despite the heavy GST cuts across major items. Only a partial pass-through of the GST cuts was likely seen in this category, along with Health (-0.15% MoM) and HH Goods and Services (0.2% MoM). Transport and Communication is likely to have had near-complete transmission of GST changes for autos, etc (-0.8% MoM). Core CPI ex-gold fell to 3.3% (vs 3.9% earlier), with monthly momentum of only 0.1%.

November CPI also tracking at <1%; FY26E now at <2%

Currently, November headline CPI is tracking at 0.9%, reflecting soft food prices, with downside risk due to spillover of GST changes. FY26E headline CPI is now <2%, implying further downside of ~50bps to the RBI’s FY26 CPI forecast of 2.6%. FY27E headline CPI forecast is at 4.1% (RBI: 4.5%). FY26E core CPI (ex-intoxicants) is at 4.5%, with FY27E moderating to 3.9%.

Heavy disinflationary bias to restart the easing cycle

We note that the RBI has been cagey on rate cuts, waiting for clarity around external and domestic uncertainties (including tariffs, GST rejig, income tax cuts, and transmission of past easing), while its continued focus on one-year-ahead expected inflation (RBI: 4%+) may also have weighed on its reaction function. However, given repeated undershoots vs forecasts, we believe the policy focus on year-ahead expected inflation is increasingly misplaced in a fast-changing environment. We see risks of a further undershoot of ~50bps/~40bps to the RBI’s FY26/FY27 CPI forecast, which could support the case for a December rate cut (and beyond, depending on how tariff effects evolve).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354