Cotton Report 03rd October 2025 by Amit Gupta, Kedia Advisory

Fundamentals

Performance

Swot Analysis

Strengths

* As on 26 Sep 2025, India cotton acreage stood lower at 109.98 lh, down by 2.63% over the same period last year.

* Telangana wants CCI to start cotton procurement from Oct. 1

* CCI to start cotton procurement at MSP from Oct 1 at 14 centres

* Cotton crop hit by excess rain in parts of Maharashtra, Gujarat, Rajasthan, Karnataka, Telangana, and AP raises concern over yield

* The Indian government has increased the MSP for cotton for the 2025-26 season by up to 11.84%.

* As per 3rd estimates, Cotton production has been hit, falling from 32.52 million bales to 30.69 million bales, down by 5.6%.

Opportunities

* Cotton output in 2024-25 is estimated at 312.40 lakh bales, down from 336.45 lakh bales in 2023-24, due to lower yields – CAI

* For 2025-26, World consumption is raised almost 850,000 bales.

* Beginning stocks for 2025/26 are almost 1 million bales lower compared to last month.

* Global ending stocks for 2025/26 are reduced by almost 800,000 bales to 73.1 million bales, the lowest in 4 years.

* Pakistan's cotton production has dropped by 30% compared to the same period last year.

* USDA projected a 2% decline in India’s cotton production during the 2025-26 season.

* Brazilian output is expected to decline 7% year-on-year to 3.72 million metric tons in 2025/26.

Weaknesses

* Spot Cotton 29mm dropped around 1.35% to 29270 in Sept as trade remained sluggish amid concerns over the US-imposed tariff and penalty on Indian exports.

* India’s cotton imports for crop year 2024-25 surge to record 39 lakh bales on lower global prices

* Indian cotton imports from Brazil up 10 times this season as shipments surge to record high

* Weak textile demand in China, competition from synthetics and a softer lint dollar have all pressure on prices.

* China's agriculture ministry has lowered its forecast for cotton imports in the 2024/25 crop year by 300,000 metric.

Threats

* Govt extends import duty exemption on raw cotton until 31st December 2025

* For 2024-25, as on Aug 25 closing stock is estimated at 60.59 lakh bales of 170 kgs each against 30.19 lakh bales last year Sep 24 - CAI

* For 2025-26, Global cotton production is forecast over 1 million bales higher

* The imports are likely to remain higher in the coming months owing to the shortfall in production

* Higher MSP increase textile mill production costs, which could result in higher consumer prices and hurt Indian cotton to compete globally.

* Speculative positioning also reflected ongoing bearishness, with net shorts rising by more than 3,300 contracts to 68,812. -CFTC data.

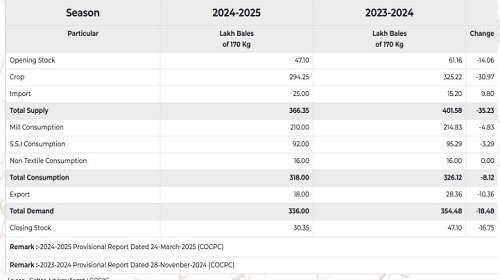

CAI Crop Report 2024-25

CONSUMPTION

The CAI has maintained its cotton consumption estimate for 2024-25 season at 314.00 lakh bales of 170 kgs. each (equivalent to 329.51 lakh running bales of 162 kgs. each) i.e. at the same level as estimated previously. Upto 31st August 2025, the consumption is estimated at 286.00 lakh bales of 170 kgs. each (equivalent to 300.12 lakh running bales of 162 kgs. each).

COTTON PRESSING

As per the latest report submitted by upcountry associations and trade sources at the meeting of the CAI Crop Committee, total cotton pressing numbers for 2024-25 season are increased by 1.00 lakh bales to 312.40 lakh bales of 170 kgs. each (equivalent to 327.83 lakh running bales of 162 kgs. each) from 311.40 lakh bales of 170 kgs. each estimated previously. The Committee members will review the cotton pressing numbers in the subsequent month and if any addition or reduction is required to be made in the pressing numbers, the same will be made in the CAI report.

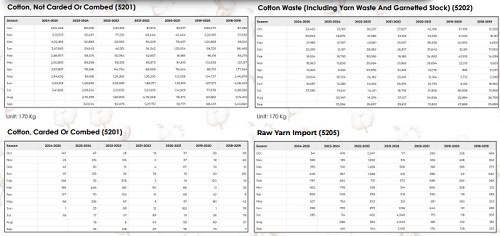

IMPORTS

The CAI has increased its cotton imports for the 2024-25 season by 2 lakh bales to 41.00 lakh bales of 170 kgs. each (equivalent to 43.02 lakh running bales of 162 kgs. each) from 39.00 lakh bales of 170 kgs. each estimated previously. The cotton imports estimated by the CAI for the season are higher by 25.80 lakh bales of 170 kgs. each than 15.20 lakh bales of 170 kgs. each estimated for the last year. Upto 31st August 2025, about 36.75 lakh bales of 170 kgs. each (equivalent to 38.56 lakh running bales of 162 kgs. each) are estimated to have arrived the Indian Ports.

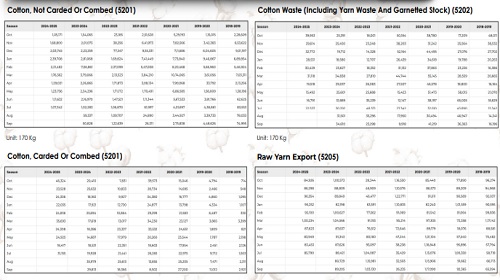

EXPORTS

The CAI has maintained its cotton exports for the 2024-25 season at 18.00 lakh bales of 170 kgs. each (equivalent to 18.89 lakh running bales of 162 kgs. each) i.e. at the same level as estimated previously. The cotton exports for 2024-25 crop year are estimated to be lower by 10.36 lakh bales of 170 kgs. each than 28.36 lakh bales of 170 kgs. each (equivalent to 29.76 lakh running bales of 162 kgs. each) estimated for the last season.

CLOSING STOCK AS AT 30TH SEPTEMBER 2025

The closing stock at the end of 2024-25 season on 30th September 2025 is estimated at 60.59 lakh bales of 170 kgs. each (equivalent to 63.58 lakh running bales of 162 kgs. each) as against 39.19 lakh bales of 170 kgs. each (equivalent to 41.13 lakh running bales of 162 kgs. each) in last year.

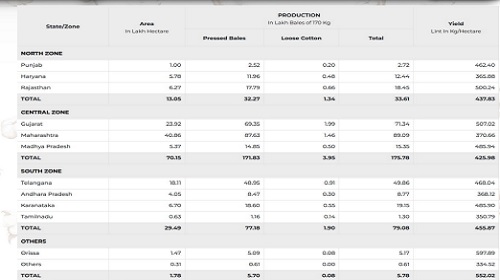

Area Production Yield - 2024/25

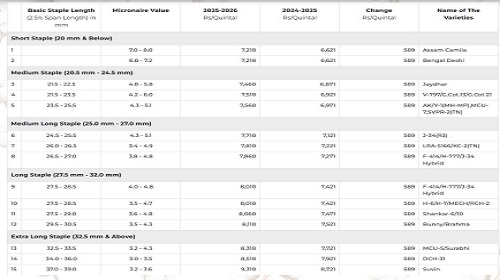

MSP of KAPAS - 2025/26

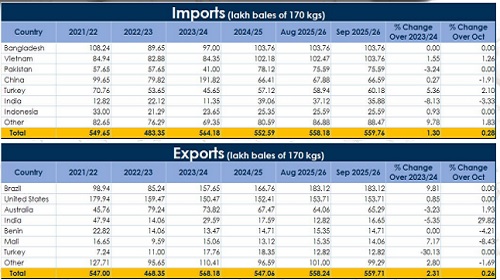

Cotton Imports

Cotton Exports

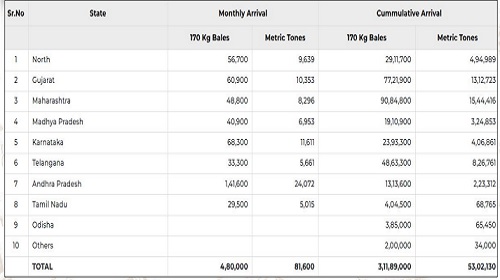

Arrivals

Balance Sheet - 2024/25

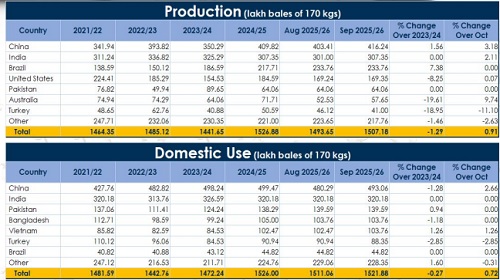

Production & Use Country wise

Imports & Exports Country wise

Ending Stocks Country wise

* Global cotton ending stocks for 2024/25 are at 948.53 lakh bales, but projected to dip slightly (-1.24%) to 936.76 lakh bales in 2025/26.

* China remains the largest holder, though stocks decline to 435.06 lakh bales (-2.5% YoY).

* India’s stocks rise to 134.12 lakh bales (+4.97% YoY), showing stronger supply buffer.

* Brazil (+33.79%) and Argentina (+11.67%) post the sharpest stock increases among major producers.

* United States (-9.99%) and Australia (-9.29%) show notable stock declines, reducing exportable surplus.

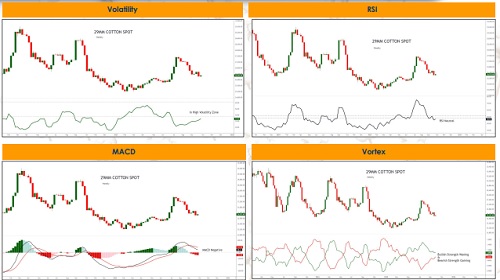

Technicals

Technicals - ICE Cotton

Technicals - 29mm Cotton Spot

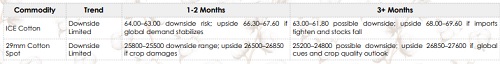

Outlook - ICE Cotton

Outlook - 29mm Cotton Spot

Conclusion

Price Performance: Cotton slipped recently under pressure from weak textile demand, higher imports, and global competition. Spot cotton 29mm also fell 1.35% in September to 29,270 amid sluggish trade. Overall, both markets reflect cautious sentiment with downside bias dominating near-term outlook.

Supply & Production: India’s cotton acreage slipped 2.63% YoY to 109.98 lakh hectares while production is pegged lower at 30.69 million bales versus 32.52 million last year. Excess rains in AP & Telangana further threatened yields, tightening domestic supply outlook.

Policy & Procurement: Government raised MSP by nearly 11.84% for 2025–26 season. CCI procurement is starting from October 1 across key centres, providing price cushion. However, higher MSP raises textile mill costs, reducing India’s global competitiveness against cheaper imports and synthetics.

Trade Balance: Imports surged to record 39 lakh bales in 2024–25, with Brazilian supplies up tenfold. India’s cotton imports for 2025 season are now estimated at 41 lakh bales, highlighting domestic supply tightness. Exports, however, remain weak at 18 lakh bales only.

Global Factors: World ending stocks are projected at 73.1 million bales, lowest in four years. US and Australia show supply declines, while Brazil & Argentina post gains. China’s imports are slowing, adding demand-side pressure. Weak textile demand and synthetics remain downside risks.

Price Outlook

Above views are of the author and not of the website kindly read disclaimer