Copper prices are expected to remain under pressure on sluggish demand growth in China - ICICI Direct

Bullion Outlook

* Spot Gold is likely to move lower towards $3300 amid strong dollar and the hawkish FOMC meeting minutes. Most members were concerned about the upside risk to inflation as a greater risk than weaker employment. Further, easing geopolitical tensions and decline in probability of September rate cut could bring correction in the bullion prices. As per CME Fed watch tool the probability of rate cut has dipped to 82% from 85% a day ago. Meanwhile, investors will also eye on Speech from Fed chair during his speech at Jackson Hole Symposium for further clarity.

* Spot Gold is expected to slip towards $3300, a s long as it trades under $3375. MCX Gold October is expected to weaken towards Rs.98,500 as long as it remains below 20 DEMA at Rs.99,600 level.

* MCX Silver Sep is expected to move towards Rs.110,800 as long as it trades under Rs.113,600 level. Only above Rs.113,600 it would turn bullish.

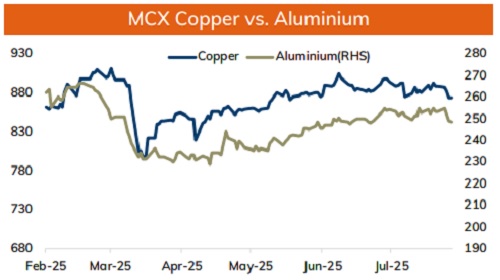

Base Metal Outlook

* Copper prices are expected to remain under pressure on sluggish demand growth in China. Further, expectation of contraction in manufacturing activity in Europe and US could hurt demand outlook. Moreover, tariff concerns after the US State Department of Commerce’s announcement of 50% tariff on imported steel and aluminium products would hurt investors sentiments and weigh on price.

* MCX Copper August is expected to move lower towards Rs.868, as long as it trades under Rs.878 level. A move below Rs.868 would weaken trend towards Rs.860

* MCX Aluminum August is expected to trade lower on improving supply scenario and muted demand. Price may slide towards Rs.246, as long as it trades under Rs.251 level. MCX Zinc August is likely to slip towards Rs.263 level as long as it stays below Rs.268 level.

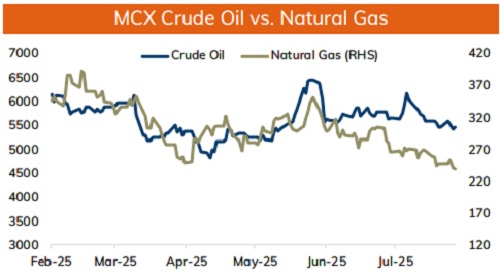

Energy Outlook

* Crude oil is likely to rebound towards $65 per barrel on improved demand outlook from US and rise in refinery usage in US and China. Meanwhile, growing prospects of an end to Russia-Ukraine war and US President's push for a trilateral meeting would ease supply concerns and restrict any major upside in oil prices. Additionally, forecast of higher output in the coming year by OPEC and EIA would weigh on oil prices.

* On the data front, 60 put strike has higher OI concentration which would act as key support. On the upside 65 call strike, has higher OI concentration, which would likely to act as immediate hurdle. MCX Crude oil September is likely to consolidate in the band of Rs.5380 and Rs.5550 level. Only a move below Rs.5380 it would turn weaker.

* MCX Natural gas September future is expected to remain under pressure and move towards Rs.2380, as long as it trades under Rs.256.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631