Consumer Durables Sector Update : Ear to ground: AC demand subdued; feedback post GST cuts mixed by JM Financial Services Ltd

Our channel checks on ACs through several geographies in India suggest: (1) 2QFY26, an inherently lean quarter, was further impacted by pleasant weather, especially in Jul’25 and Aug’25 (North and East saw a temperature increase in Sep’25, while West and South enjoyed pleasant temperatures) and the expectation of a GST rate cut. (2) For the quarter, we note declines of 40%+ YoY in the West and the South. The trends were much better in the North, especially that of 30%+ YoY growth in Sep’25, while Jul’25 and Aug’25 saw declines. (3) Post GST cuts and through the festivities, demand in the West and the South has failed to pick up, despite lower ASPs, due to lower temperatures. In the North, the pickup in demand appears to stem from rising temperatures and humidity, with some push from lower prices.

* 2Q demand trends weak, on expected lines: From our channel checks, we note that demand trends across 2QFY26 have remained weak. This was owing to (1) 2Q being inherently lean, and palatable weather conditions negating the need for air conditioners in several geographies; (2) announcement of GST cuts on 15th Aug’25 by the Prime Minister, driving some incremental deferment of decisions; and (3) the lack of any pickup post GST cuts in several pockets given other exciting avenues to spend through festivities (mobile phones, large TVs, holidays, etc), and pleasant temperatures. We understand that the channel holds close to 2 months of incremental inventory currently.

* Feedback on revival post GST cuts mixed across geographies: Feedback on revival post GST cuts coming into effect from 22nd Sep’25 remains mixed across geographies. While demand in North India appears to have picked up to some extent, trends remain discouraging in West and South India. To put this into perspective, dealers and distributors in the West indicated YoY declines of 40-60% through the quarter, with trends remaining similar post GST cuts and during festivities. On the other hand, our discussions in the North suggest that owing to high temperatures and rising humidity, demand in Sept’25 grew ~30% YoY, while Jul’25 remained flattish, and Aug’25 was weak (~30% YoY decline), indicating a flat quarter.

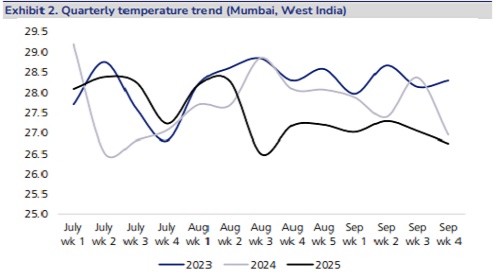

* AC demand a factor of rising temperatures than lower prices: AC demand is a factor of soaring temperatures than lower ASPs, especially when it comes to rising penetration. While some replacement demand was deferred given an expectation of rate cuts, new demand stems predominantly from rising temperatures, clearly visible from weather trends across gregraphies (exhibits 2-5). Temperatures in the West through 2QFY26 remained lower than historical levels. Vis-à-vis 2023/24, temperatures across Aug’25 and Sep’25 hovered ~2 degrees lower. In North India, temperatures across Jul’25 and Aug’25 remained lower, but, starting Sep’25, there was a sharp increase in temperature and humidity levels. Across East India, an increase was seen from the 2nd/3rd week of Sep’25, after sharp dips through Jul’25 and Aug’25. Across South India, Jul’25 temperatures were higher than in 2023 and 2024, with a slight dip in Aug’25 and no major rise in Sep’25.

* Worst year in decades, but confident of macro: Several dealers and distributors, especially in the West, alluded to this being the worst year in 20+ years of business, with business trends being worse than during Covid times as well. At the same time, they remain confident of macro penetration and not considering diversifying into other electronic products.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

Tag News

Realty Sector Update :Developers, Flexible Office Space and Construction by Choice Institut...

More News

Auto Sector: Q4FY25 Auto OEM Review ? Growth in 2W/Tractor OEMs By Axis Securities Ltd