Company Update : Vishal Mega Mart By JM Financial Service

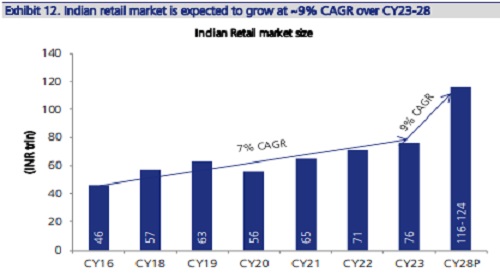

Growth longevity enabled by large TAM…: The Indian retail market was valued at INR 76trln in CY23 with VMM catering to ~50% of this market. Within this, the organised market is expected to grow at a faster clip led by rising brand awareness, focus on better quality products and store expansion by organised retailers. Tier 2 towns account for ~74% of India’s retail spends and are dominated by unorganised retailers. Given VMM’s highly saliency towards Tier 2 towns and its strong track record of operating in this space, we believe it is well placed to ride this huge opportunity.

…and strong unit economics supported by high private label salience and efficient supply chain…: VMM – aided by its (i) high private label salience (~73%), (ii) higher mix of apparel and general merchandise mix in overall sales (>70% aggregate), and (iii) efficient supply chain, which ensures asset-light operations – operates on a very lean cost structure and an efficient inventory management system, which is the heart of retailing. Overall, this helps it to generate ~58% RoCE (posttax), translating into a payback period of ~21 months.

… paves the way for accelerated store expansion: Our analysis suggests VMM can add ~1,500 stores over the next ~15 years with an estimated annual addition of ~100 stores. It can expand stores not only by entering into new cities/towns but also by increasing penetration in existing cities. We note that in 81% of its total city coverage, VMM has only 1 store. It is now focused on expanding in the high per capita GDP states where its penetration is low.

Financial performance: We estimate VMM to register robust Revenue/ EBITDA/PAT CAGR of 19/26/27% led by area addition at ~10% CAGR and low-double-digit SSSG, leading to rev/sqft growing at a CAGR of ~8% over FY25-28. We expect EBITDA margin expansion of ~170bps primarily led by operating leverage benefits, leading to EBITDA margin of 10.7% (Pre-Ind AS) by FY28. Improved profitability along with high asset turns is expected to yield strong RoE/RoCE (ex-goodwill) of 47/80% by FY28.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361