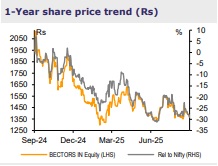

Company Update : Mrs Bectors Food Specialities Ltd by Emkay Global Financial Services

Voice of the Head – Aspiring for mid-teen growth

We met Manu Talwar, CEO of Mrs Bectors Food Specialities, to gain an insight into the company and the industry. The company generates ~28% of its revenue from the domestic biscuit market. Ahead, it expects the market to grow faster, led by GST rationalization. Biscuit exports contribute 1/3rd of the total revenue, although US tariffs have hit the near-term performance. The management sees bakery as a growth opportunity, with 36% of revenue. In bakery, the share of B2C is 2/3rd (1/4th of total revenue); the company is looking at a pan-India play by augmenting capacity and aligning innovation with health. The management aspires for mid-teen growth in the long term, although near-term growth would be hit by export slowdown. The management targets 13-14% EBITDA margin, which will expand with scale. As the company commissions capacities, utilization levels across segments are likely to ease to 60-65%, keeping capex low over the medium term.

Biscuits mainly offer export opportunity; GST enhances the domestic outlook

The company generates 2/3rd of its revenue from biscuits (55% comes from export markets, where white label and branded play are equal). In the domestic business, the company holds 14% share in the North. Ahead, its thrust is on key markets like Delhi, Haryana, Rajasthan, and Uttar Pradesh, along with developing markets like Maharashtra, Gujarat, and Central India (after commissioning of the Madhya Pradesh capacity in Q2FY26). As of now, the focus on South India is limited. The management is looking to have a differentiated product strategy, as base products in the category face stiff competition. Revenue in domestic business can be divided into 70% from general trade (16% is from Cremica preferred outlets), 10% from modern retail channel, and the balance 20% from institutional supplies like CSD and HORECA.

Bakery, a wider formalization-led growth opportunity; focus on pan-India play

With fast formalization expected, the company has been aggressive in setting capacities across regions. It is looking to be among the top 3 companies in the B2C segment (1/4th of revenue), with quality as its prime focus. Ahead, growth would be driven by expanding distribution (with pan-India facilities) and aligning innovation with consumer needs (more health-focused). Health is the key proposition on which the category sees steady formalization. The management is keen to ride the health wave with quick commerce, which accounts for >25% of domestic bakery revenue. The company entered the readyto-eat segment with the launch of Choco Lava Cake, Muffins, and Brownies (which have been positioned in quick commerce and Cremica preferred outlets). Recently, the company launched its clean bread brand – Naturbaked.

Capacity commissioning to aid execution ahead

The company has gone through a capex cycle. After commissioning of bakery capacities in FY26, utilization levels would improve which will support growth ahead.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354