Company Update : Adani Ports and SEZ Ltd By JM Financial Service

Port volumes for 1HFY26 at 244mnt trends below guidance (505-515mnt) but on track with our estimate of 500mnt. EBITDA for 2QFY26E potentially at INR56-57bn clearly on track to exceed upper end of FY26 EBITDA guidance of INR210-220bn (JMFe FY26: INR230bn)

* 1HFY26 volumes indicate potential miss on FY26E volume guidance: ADSEZ management had guided for FY26E volumes at 505-515mnt (FY25 at 450mnt). However, the 1HFY26 cargo at 244.2mnt implies the ask rate for 2HFY26E at 261-270mnt is fairly steep. The 2QFY26 monthly average volumes are at 41.2mnt and if we adjust for seasonality (4% uptick between 2H and 1H) we can expect 2HFY26E volumes at 253mnt. Thus, FY26 volumes may likely end around 500mnt (inline with our estimate).

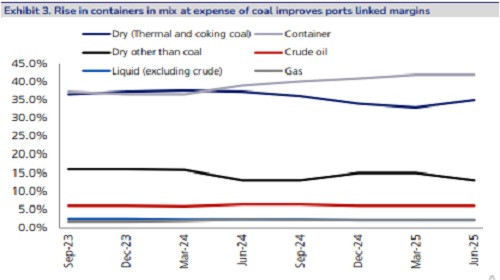

* But improving cargo mix and increases in marine/logistics EBITDA can lead to EBITDA beats: A straight math of a potential volume miss translating into an EBITDA miss is misunderstood concept for ADSEZ in our view. The volume weakness is largely offset by improved mix as container growth remained strong at 20% in 1HFY26 which potentially implies 44% container share in cargo mix in 2QFY26 vs 40% in 2QFY25 and 42% in 1QFY26. The share of other cargo (lower margin) especially thermal coal may dip further and may likely be flattish q-q at 70mnt. Further, we are witnessing sustained growth in logistics and marine revenues/EBITDA which are not captured in the volume data. All this considered we expect 2QFY26E EBITDA at INR56- 57bn leading to 1HFY26 EBITDA at INR112bn. This is well on track to exceed the guidance of INR210-220bn and FY26E EBITDA may end around INR230bn (inline with our estimates).

* FY25 too witnessed a similar phenomenon of volumes miss but EBITDA beat: FY25 volume guidance was 460-480mnt but delivery was 450mnt due to weak thermal coal imports and issues faced at Gangavaram port. Currently, thermal coal imports remain weak though issues faced at Gangavaram is largely getting sorted (this is partly offset by weak iron ore exports). Yet despite the volume miss in FY25, the EBITDA of INR190bn exceeded an upwardly revised guidance of INR170-180bn for FY25. We expect a similar phenomenon in FY26 as well.

* ADSEZ is our primary candidate for consensus EBITDA beats in FY26/27E: The Bloomberg consensus expectations for EBITDA are around INR218bn (FY26) and INR249bn (FY27) which we view as too cautious. In the event FY26 EBITDA is around INR230bn then consensus implied growth is a modest 8% which can easily be exceeded. We thus expect consensus EBITDA estimates for FY27E to be revised to INR260-270bn in the upcoming quarters. We note neither our estimates nor consensus appears to be factoring in NQXT acquisition from Adani Enterprises.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361