Commodity Research - Morning Insight - 17 July 2025 : Kotak Securities

Bullion –

Comex August gold futures rose 0.67% on Wednesday, settling above $3,359 per ounce, while September silver posted moderate gains on a weaker dollar and a fall in 10-year Treasury yield. Gold prices triggered a sharp rally to the day high of $3,386 from day low of $3,326 within just over 1-hour trade as safe-haven demand surged following reports that Trump is considering removing Fed Chair Powell. Bloomberg cited a White House official suggesting Trump could act soon, a sentiment echoed by lawmakers after a recent meeting. Although, president said he’s “not planning on doing anything” to remove Powell. Meanwhile, the June U.S. PPI slowed to 2.3% y/y, below the forecasted 2.5%, reinforcing expectations of continued Fed policy easing. Today, gold is trading steady below $3,350 as market focus now turns to Fed speeches, Retail Sales, jobs data, and the Manufacturing Index report.

Crude Oil –

WTI crude oil prices closed slightly lower at $66.4 per barrel on Wednesday, as traders weighed a mixed U.S. inventory report and awaited further clarity on Trump’s trade policy. Latest EIA report showed U.S. crude oil inventories fell by 3.9 million barrels for the week ending July 11, bringing total commercial stockpiles to 422.2 million barrels, about 8% below the five-year seasonal average. However, gasoline inventories rose by 3.39 million barrels, while distillate stocks increased by 4.17 million barrels, suggesting softer demand during the peak driving season. Today, oil prices rebounded to $67 per barrel, supported by renewed optimism over trade discussions as President Trump signaled progress in negotiations with the EU and India.

Natural Gas -

NYMEX Henry Hub Gas futures jumped to $3.59/mmBtu yesterday, buoyed by cooling demand prospects and expectations of a smaller inventory build.

Base metals –

LME base metals ended mixed on Wednesday, with zinc being the sole gainer, rising over 0.50% to settle at $2711/oz. On the other hand, copper prices witnessed decline, pressured by a sharp 10,525-ton increase in LME inventories, the largest since midFebruary. Copper’s recent momentum faltered as traders grew cautious ahead of the US’s planned 50% import tariff on copper, set to take effect on August 1, making rerouting shipments to the US increasingly risky. As a result, copper flows weakened globally, with a notable drop in inventory withdrawal requests from LME warehouses. President Trump’s latest comments on tariffs, threatening rates of up to 15% for over 150 countries, alongside his continued criticism of Fed Chair Powell, added to the cautious tone across metal markets. LME metals may face pressure as the dollar hovers near the 99 level, while a sharp rise in LME inventories might further weighs on market sentiment.

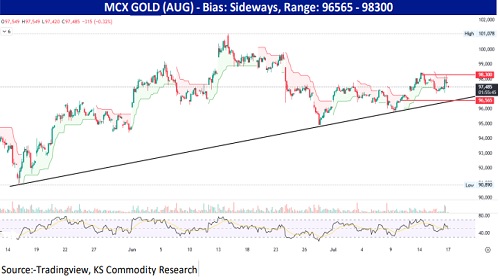

GOLD

SILVER

CRUDE OIL

COPPER

Above views are of the author and not of the website kindly read disclaimer