Commodity Morning Insights 19th September 2025 - Axis Securities

Commodity Derivatives Snapshot

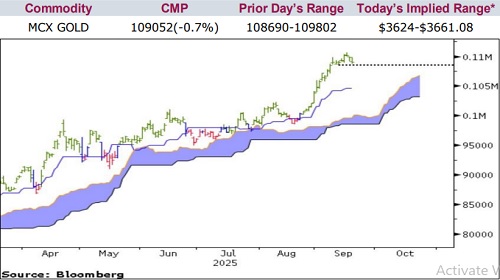

* Comex Gold extended its decline for a second consecutive session as investors digested the FOMC statement and booked profits after the Federal Reserve’s projections for 2026 turned out to be less dovish than anticipated. Prices are currently hovering near $3,640, which aligns with the 9 EMA on the daily chart. A sustained break below this level would be considered a negative signal and could open the way for a decline towards $3,600 in the near term. Meanwhile, a recovery in the dollar index has further reduced the appeal of the yellow metal

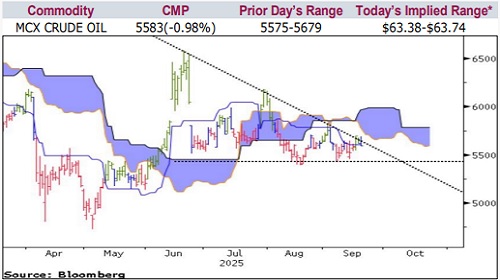

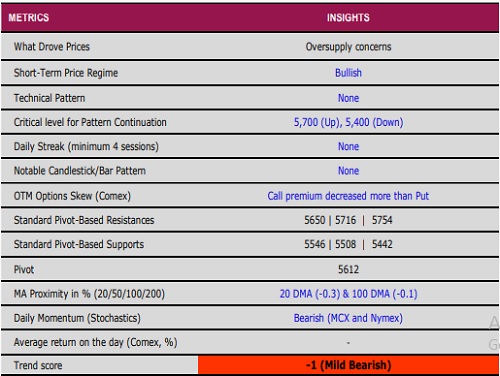

* Nymex Crude Oil slipped nearly 1% in the previous session as weak economic data and concerns over excess supply weighed on sentiment. The contract has been consolidating within a trading band of $5,700–$5,400 for the past month, with a clear directional move likely to emerge only once the range is decisively breached

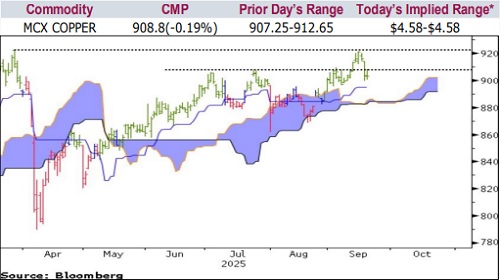

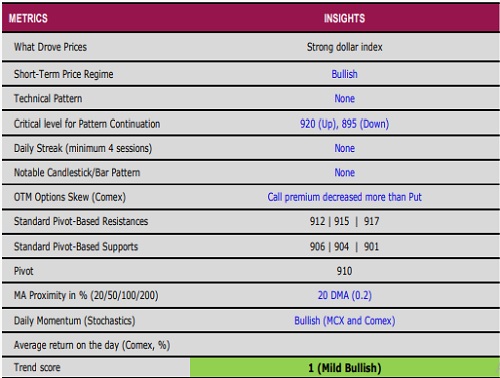

* Comex Copper settled lower for the third straight session, pressured by a firmer dollar index and the Fed’s less accommodative outlook for 2026. Adding to the downside, the world’s top copper producer in Chile indicated that output is expected to rise over the next three years, dampening market sentiment

* Nymex Natural Gas fell more than 2.5% in the last session after U.S. inventories increased by 90B cubic feet, compared with expectations of 80B. The larger-than-forecast build triggered profit-taking, dragging prices lower. On MCX, immediate support is seen near the 255 level, and a breakdown could push prices further down towards the 248/244 levels.

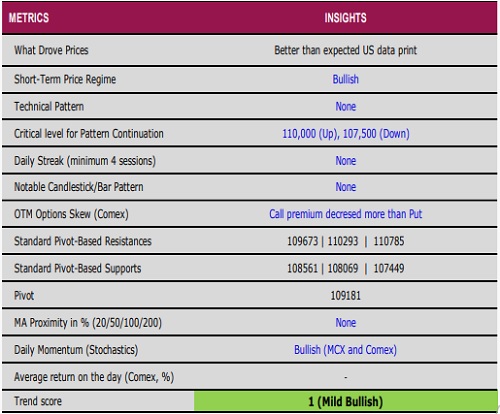

Gold

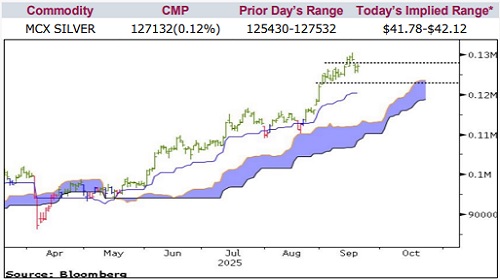

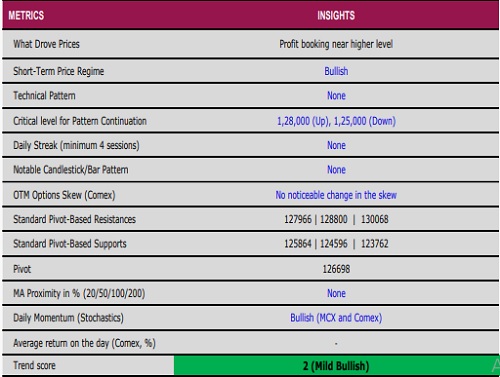

Silver

Crude Oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Buy Turmeric Dec @ 15100 SL 14900 TGT 15300-15500. NCDEX - Kedia Advisory