MCX Copper April is expected to slip further towards Rs.830 level as long as it stays below Rs.845 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to rise further towards $3080 level on weakness in dollar and softening of US treasury yields. Further, demand for safe haven may increase on fears that escalating trade war would hurt global economic growth. Federal Register filings showed US administration is advancing investigations into pharmaceutical and semiconductor imports in a bid to impose tariffs. Moreover, traders bet that economic slowdown in the wake of Trump's erratic and sweeping tariffs on trading partners will eventually prompt Federal Reserve to lower interest rates. Additionally, ECB is expected to cut rates by 25 basis points when it concludes its 2-day meeting.

* Spot gold is likely to rise towards $3080 level as long as it stays above $3220 level. A break above $3080 level prices may continue to rally towards $3300 level. MCX Gold June is expected to rise towards Rs.94,000 level as long as it holds the support near Rs.93,000 level

* MCX Silver May is expected to rise further towards Rs.96,000 level as long as it trades above Rs.93,500 level.

Base Metal Outlook

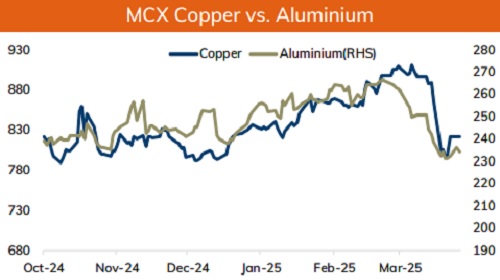

* Copper prices are expected to trade with negative bias on pessimistic global markets. Further, investors will remain cautious on concerns about the impact of US President Donald Trump's trade tariffs on the US economy. Additionally, investors will remain cautious ahead of slew of economic data from China and US to gauge economic health of the countries. Traders now await comments from Fed Chair Jerome Powell, scheduled to speak today, for more clues on the interest rate path. Meanwhile, market is also watching developments in the probe into possible copper tariffs

* MCX Copper April is expected to slip further towards Rs.830 level as long as it stays below Rs.845 level. A break below Rs.830 level prices may dip further towards Rs.825 level

* MCX Aluminum April is expected to slip further towards Rs.228 level as long as it stays below Rs.235 level. MCX Zinc April is likely to move south towards Rs.247 level as long as it stays below Rs.253 level.

Energy Outlook

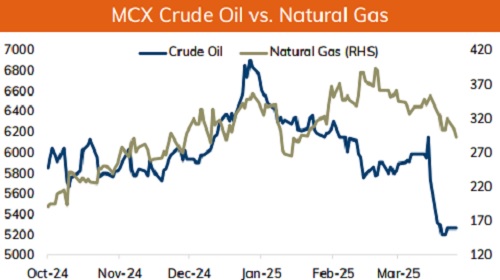

* NYMEX Crude oil is expected to trade with negative bias and slip further towards $60 on risk aversion in the global markets and as traders asses potential impact of escalating trade tension between US and China on global economic growth and oil demand. Market fears that US President Donald Trump tariffs on trading partners and their retaliatory tariffs will hurt fuel demand, which even made international organization like OPEC, EIA and IEA to cut their demand forecast. Additionally, API reported a surprise increase in weekly domestic crude stockpiles. Crude inventories increased by 2.4M barrels for the week ended 11th April. While, official government inventory report is due today.

* MCX Crude oil May is likely to slip towards Rs.5100 level as long as it stays below Rs.5400 level. A break below Rs.5100 prices may dip further towards Rs.5000 level.

* MCX Natural gas April is expected to face stiff resistance near Rs.292 level and slip towards Rs.275 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631