MCX Aluminum July is expected to slip towards Rs.247 level as long as it stays below Rs.251 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to find support near $3280 level and move higher towards $3350 amid weak dollar. Investors will move towards the safer asset class amid rising US Govt. debt and trade deal uncertainties. Additionally, investors are worried that despite of having trade deals with major trading partners, tariffs are still going to be significantly higher than they were before, fueling inflationary fears. Moreover, safe haven buying would emerge after US President confirmed that the tariffs will take effect on August 1. On the other hand, diminishing probability of early rate cut by the Fed in July could restrict the upside in the yellow metal

• Spot gold is likely to hold support near 50-day EMA at $3280 per ounce and move back towards $3350 level. MCX Gold Aug is expected to hold the support of Rs.96,000 level and rebound towards Rs.97,500 level

• MCX Silver Sep is expected to rise towards Rs.109,500 level as long as it trades above Rs.107,200 level.

Base Metal Outlook

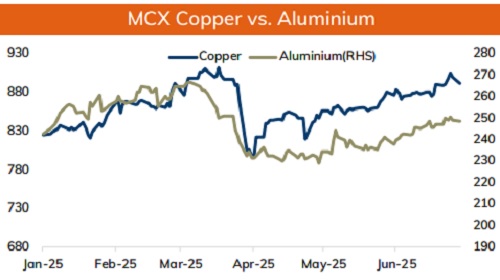

• Copper prices are expected to trade with negative bias amid uncertainty surrounding trade deal. Several large trading partners of US including EU and Japan have yet to finalize deal ahead of extended deadline of 1st August. Further, rise in SHFE stocks and declining copper premiums in China would likely to weigh on metals prices. Meanwhile, sharp fall in prices may be cushioned on worries over supply disruption in Peru and expectation of more stimulus packages from China to boost domestic consumption.

• MCX Copper July is expected to slip further towards Rs.880 level as long as it stays below Rs.896 level. A break below Rs.880 level prices may slide further towards Rs.875 level

• MCX Aluminum July is expected to slip towards Rs.247 level as long as it stays below Rs.251 level. MCX Zinc July is likely to move south towards Rs.255 level as long as it stays below Rs.259 level.

Energy Outlook

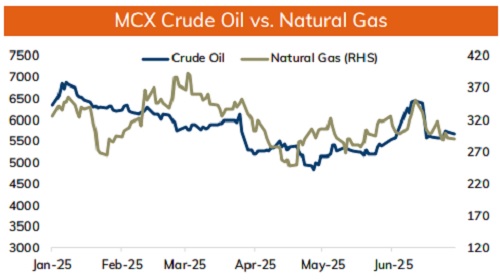

• Crude oil is likely to slip further towards $64 after OPEC+ accelerated production hikes. The group agreed to raise output by 548,000 barrels per day in August, up from previous monthly increases of 411,000 bpd. Accelerated production hikes will raise concerns about oversupply, which is almost 80% of the 2.2 million bpd voluntary cuts from OPEC. Adding to the bearish sentiment, investors continued to assess the potential impact of US tariffs on global fuel demand.

• MCX Crude oil July is likely to slip towards Rs.5500 level as long as it stays below Rs.5740 level. A higher OI concentration in ATM and OTM call strikes indicates prices to face stiff resistance.

• MCX Natural gas July is expected to slip towards Rs.280 level as long as it stays below Rs.298 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631