MCX Natural gas August future is expected to consolidate in the band of RS.260 and RS.275 - ICICI Direct

Bullion Outlook

* Spot Gold is likely to hold support near $3330 and rise towards $3400 on softer dollar and growing bets of loose monetary policy from the US Fed. Further, tariff concerns and weakness in the US economy would increase its investment outlook. Additionally, geopolitical turbulence would provide support to prices. Prices may get support from loose monetary policy from Bank of England as the BOE is likely to lower the rates by 25 bps in today’s meeting. Meanwhile, investors will eye on progress in talks between US and Russia. Any positive outcome might reduce the precious metals safe-haven appeal.

* On the data front, a strong call base at 3450 might act as immediate hurdle. MCX Gold October is expected to hold support near RS.100,500 and move higher towards RS.101,800 level. A move above RS.101,800 would open the doors towards RS.102,200.

* MCX Silver Sep is expected to hold the key support near RS.112,000 and move higher towards RS.114,800 level.

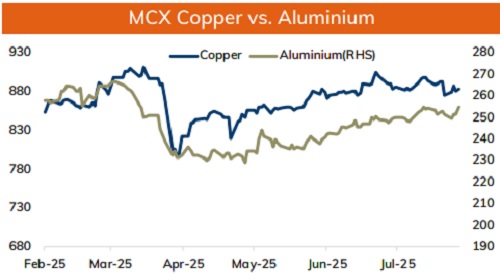

Base Metal Outlook

* Copper prices are expected remain under pressure amid sluggish demand growth from China. Further, expectation of weaker export numbers and tariff concerns would also weigh on metal prices. Moreover, rising inventory levels in LME could also weigh on the metal prices. Meanwhile, supply side issues from Chile would limit its downside. Chilean state-owned copper producer Codelco has halted ore processing at its biggest copper mine leading to drop in output.

* MCX Copper August is expected to consolidate between RS.878 and ?890level. Only a move below RS.878 level prices may turn weak towards RS.872 level

* MCX Aluminum August is expected to rise towards RS.257 level as long as it holds above RS.252 level. MCX Zinc August is likely to move north towards RS.270 level as long as it stays above RS.265 level.

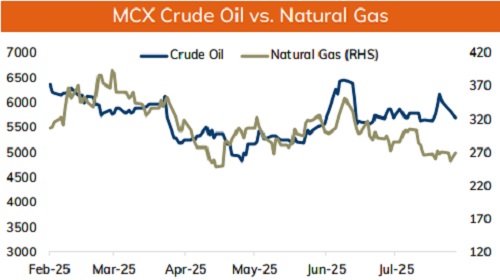

Energy Outlook

* Crude oil is likely to remain under pressure on claims of progress in Ending Russia- Ukraine war. As Russia is considering a pause on air strikes to try and fend Trump’s threat of secondary sanctions. Additionally, higher OPEC+ supplies and concerns over weaker US economic numbers would also weigh on prices. Meanwhile, improved demand from US refineries would limit the downside in oil prices. Additionally, price rise by Saudi Arabia to Asia on strong demand and tight supply would help prices to stay above $64 mark.

* On the data front, 60 put strike has higher OI concentration which would act as key support. On the upside 70 call strike, has higher OI concentration, which would likely to act as immediate hurdle. MCX Crude oil Aug is likely to dip towards RS.5600 level, as long as it stays belowRS.5850 level.

* MCX Natural gas August future is expected to consolidate in the band of RS.260 and RS.275. Only above RS.275 it would turn bullish and rise towards RS.282.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631