Commodity Morning Insights 10th September 2025 - Axis Securities

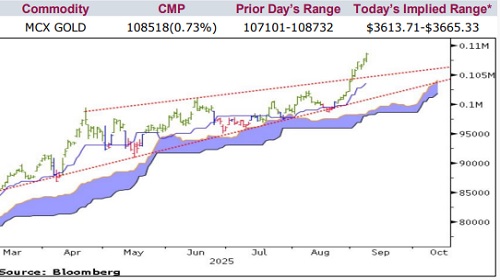

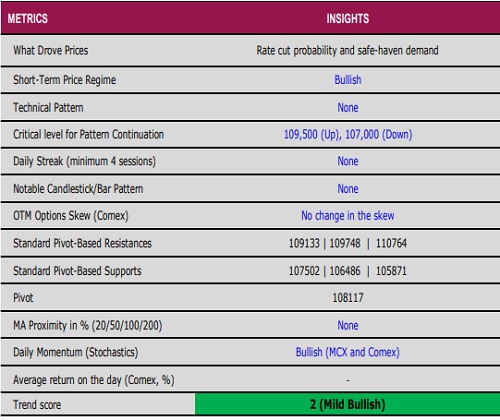

* Comex Gold extended its gains for a second consecutive session, climbing to fresh record highs in the spot market after breaching the $3,640 mark. A softer dollar index, along with rising expectations of a rate cut, prompted strong safe-haven inflows. Investors now look ahead to the release of the FOMC minutes for further guidance on the policy outlook

* Nymex Crude Oil halted its three-day losing streak, settling nearly 1% higher in the previous session. The recovery came as OPEC+ announced a slower pace of output increases, with the group agreeing to add 137,000 barrels per day from October, well below the recent additions of 555,000 bpd in August–September and 411,000 bpd in June–July

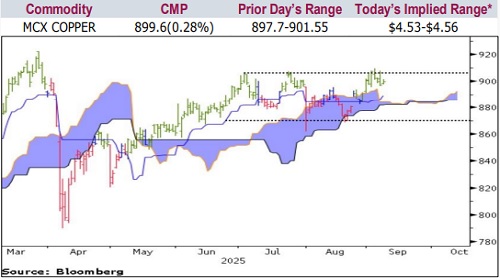

* Comex Copper also snapped a three-day decline, gaining over 0.5% in the last trade. Supply risks remain in focus as operations at Chile’s El Teniente mine remain suspended, and any prolonged disruption could support prices at lower levels

* Nymex Natural Gas closed on a firm note, supported by supply concerns and forecasts of warmer weather across the US, which are expected to lift demand for cooling

Gold

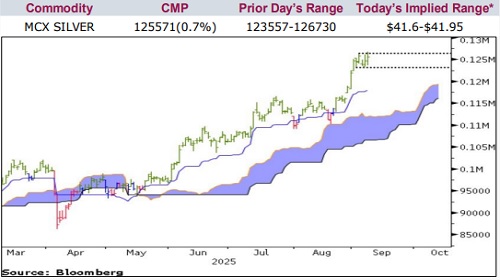

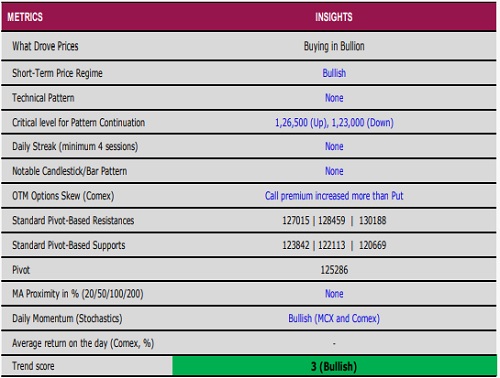

Silver

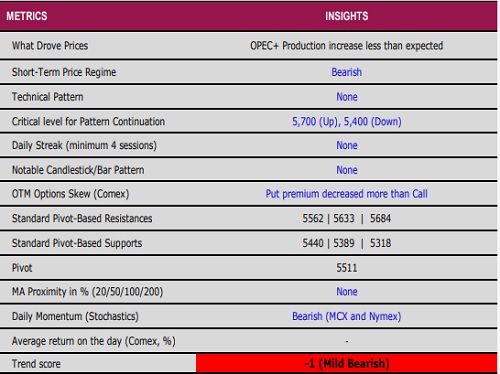

Crude Oil

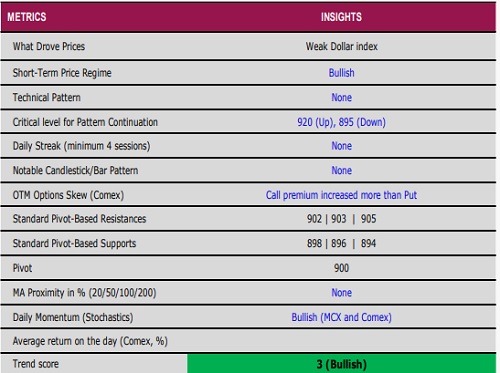

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633