Commodity Morning Insights 02 July 2025 - Axis Securities Ltd

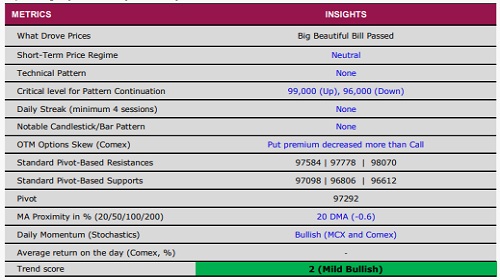

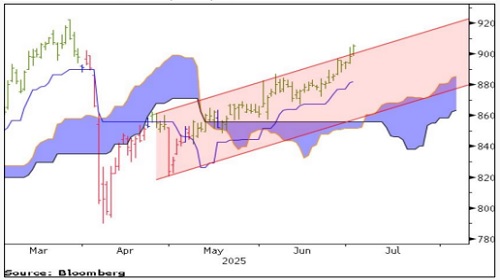

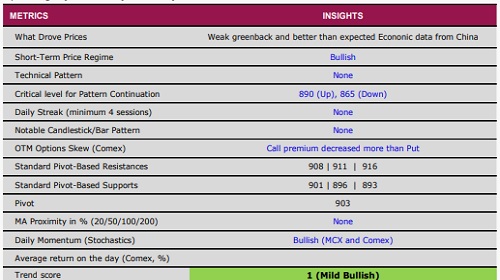

* Comex Gold extended gains for a third consecutive session, closing over 0.6% higher and surpassing the immediate resistance zone near the $3,350 mark. The metal found support after the U.S. Senate approved the widely watched “Big Beautiful Bill”, while U.S. private sector job data showed a decline in Jun’25. Market focus now shifts to the upcoming Non-Farm Payrolls data, which is expected to guide bullion's direction for the rest of the month

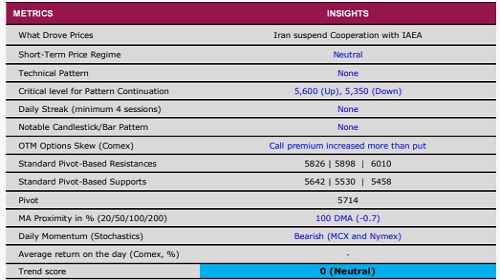

* Nymex Crude Oil rallied more than 3% in the last session amid escalating geopolitical tensions. Iran’s suspension of cooperation with the U.N. nuclear watchdog triggered a modest risk premium, despite an unexpected build in U.S. crude inventories. Although OPEC+ reaffirmed its intention to gradually increase output, the market appears to have largely priced in these developments, with Saudi Arabia notably ramping up exports in Jun’25

* Comex Copper prices gained nearly 2% on signs of improved demand from China. A rebound in Chinese manufacturing activity last month indicates that the world’s top copper consumer is seeing early benefits from a cooling of U.S.-China trade tensions. Traders are closely monitoring any fresh signals from ongoing trade discussions

* Nymex Natural Gas rebounded more than 2%, snapping a two-day losing streak, as hotter mid-July forecasts boosted expectations of stronger air-conditioning demand. A lower-than-expected inventory build and lingering winter supply concerns, particularly for January contracts, continue to support prices in the near term

Gold

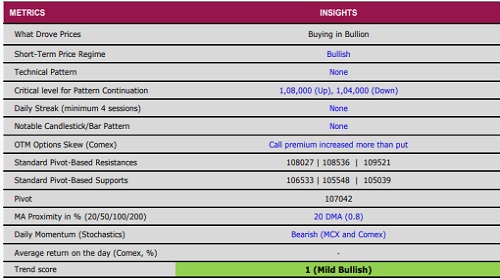

Silver

Crude Oil

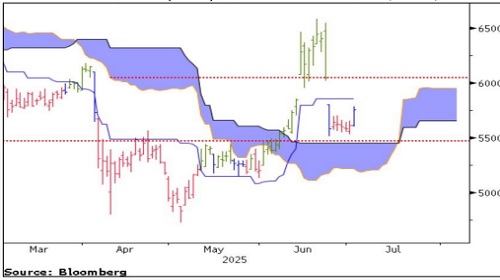

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633