Buy TIPS Music Ltd For Target Rs. 920 By Yes Securities Ltd

Growth moderates, but outlook remains intact; maintain BUY

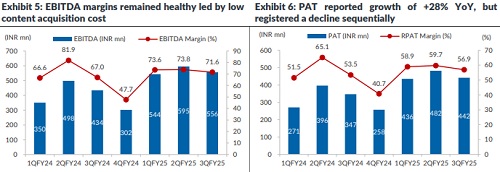

TIPS Music managed to sustain growth momentum in Q3FY25, however, missed our estimates as revenue grew by 20% YoY, but moderated QoQ. EBITDA margin remained healthy with +460bps expansion YoY, led by lower content cost. This resulted in healthy PAT growth of 28% YoY. Management is confident of achieving 30% topline and bottom-line growth over next few years driven by improved monetization of content and industry tailwinds. We believe medium term growth prospects for the company remain intact as incremental revenue drivers (short format videos, live performances etc.) come into play in coming quarters. We trim our estimates on account of Q3 miss but remain bullish on the outperformance of Indian music industry in the medium term with TIPS Music being the key beneficiary. We maintain BUY rating on the stock, with revised TP of Rs920.

Result Highlights

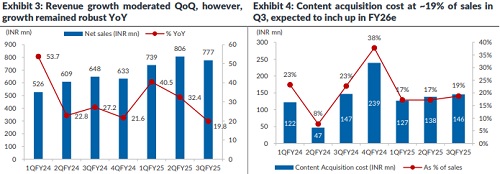

* Q3FY25 revenue reported growth of 20% YoY but declined by ~4% QoQ, likely due to fewer superhit releases in the quarter. However, upcoming line-up of music releases is robust. Further, investments behind new content acquisition are expected to increase in FY26, which should support future growth.

* Mgmt plans to focus on producing and acquiring higher quality content going forward with lower number of new releases compared to FY23 and FY24. In line with this strategy, TIPS has added 338 new songs in 9MFY25 (116 in Q3) vs 733 songs in FY24. In Q3, company launched 40 films songs and 76 non-films songs.

* Company has also collaborated with TikTok for international geographies. Though the quantum of this deal is relatively small, it should support growth in coming quarters as revenue from this deal will be recognized from Q4FY25 onwards, based on the number of streams.

* Growth in YouTube subscribers remained healthy with total subscriber base exceeding 113mn, implying 3-yr subscriber CAGR of 20%. YouTube views for 9MFY25 reached 171.6bn, growth of +17% YoY. For Q3FY25, YouTube views stood at 52.8bn (+12% YoY), with a 3-year CAGR of +31%.

* Management expects growth in premium subscriptions as well as free subscribers for YouTube to continue drive growth. Management view is bolstered by sharp growth reported by Spotify India in FY24. Spotify India reported subscription revenue growth of 90% and Ad-revenue growth of +114% for FY24, indicating robust demand trend for music streaming services in India. Growth in premium subscription, albeit currently at a small base, should help drive top-line growth with margin improvement over time, as realization per stream is 2.5x vs free subscribers.

* YouTube has increased the duration of short video format to 180 seconds, in-order to increase advertising income from short videos. Meta has also followed suit. This should bode well for TIPS in medium term as number of streams are much higher in short video format. Management expects this to be a significant revenue driver in the medium term and expects contribution to reach as high as 25% of revenues.

Valuation

We trim our FY26/FY27 EPS estimates by -8%/-15% on account of Q3 miss and inline with the management guidance. However, we believe long term prospects for the industry remain intact and TIPS is likely to be the key beneficiary. We value the stock at FY27E PE of 47x and maintain BUY with revised TP of Rs920. Stock is currently trading at attractive valuation with FY26/FY27E P/E of 37x/29x.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632