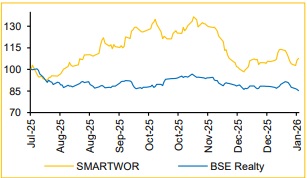

Buy Smartworks Coworking Spaces Ltd For Target Rs. 630 by Choice Broking Ltd

Q3FY26 Review: Stronger-than-expected Top-line Performance

* Revenue from operations stood at INR 4,721 Mn, representing an increase of 11.1% QoQ and 34.2% YoY, supported by an expanding base of mature centres, exceeding CIE’s est of INR 4,250 Mn

* EBITDA was reported at INR 3,056 Mn, reflecting an increase of 13.1% QoQ and 40.0% YoY, surpassing CIE’s est of INR 2,732 Mn. The EBITDA margin stood at 64.7% (vs. 63.6% in Q2FY26 and 62.0% in Q3FY25), and was slightly higher than CIE’s est of 64.3%

* RPAT stood at INR 12 Mn, as compared to losses after tax of INR 31 Mn in Q2FY26 and INR 160 Mn in Q3FY25 (RPAT was below CIE’s est of INR 48 Mn). The RPAT margin for the quarter was 0.3%, vs. CIE’s estimate of 1.1%

* Operational seats stood at 2,09,000 in Q3FY26 as compared to 2,07,000 in Q2FY26. Total operational seats increased 1.0% QoQ and 13.6% YoY. Overall occupancy stood at 84% with seat retention rate of 93%

Management Call Highlights

Macro Environment:

* The shift towards integrated, capital-intensive coworking campuses is significantly raising entry barriers. As a result, large enterprise demand is concentrating among a few scaled up institutional platforms

* Southern India remains a strong but increasingly competitive flexible workspace market, with growth now led mainly by selective enterprise demand. Expanding into West and North India enhances portfolio diversification, reduces concentration risk and provides exposure to emerging growth corridors

Operations:

* Total footprint increased to ~15.3 msf, with 2.6 msf added during the quarter and 1.7 msf of LOIs signed in Q3 FY26

* Presence across 15 cities, serving ~770+ clients

* Committed occupied seats crossed ~1,92,000

* Revenue growth was primarily driven by enterprise clients, contributing over 90% of rental income. Demand remained focused on large, long-tenure deployments, with ~36% of rental revenue coming from over 1,000+ seat-clients in Q3 FY26

* Revenue contribution from multi-city clients stood at 31%. Management is expecting this to increase, going forward

* Mature centre footprint reached 7.8 msf in December 2025, committed occupancy at mature centres remained at ~92%

* SmartVantage is seeing strong demand. SMARTWOR has signed over 4 large major GCC deals with European and American clients

Financials:

* ROCE rose sharply, from ~14% in Q2 to ~21% in Q3, reflecting improved capital efficiency driven by margin expansion, better asset turnover and disciplined capital deployment

* Operating cash flow exceeded EBITDA in Q3, reversing the Q2 dip caused by timing of security deposits

* Net debt in Q3FY26 decreased to INR (418) Mn as compared to INR 2,772 Mn in Q3FY25. Borrowing cost has reduced significantly, from ~10.8% in Q3FY25 to less than 9% in Q3FY26

* During the quarter, the company’s credit rating was upgraded by two notches to CARE A (Stable) from CARE BBB+ (Positive), reflecting its strong financial profile, liquidity position, and improved debt servicing capability

Guidance:

* Margin is expected to expand QoQ driven by portfolio maturity, increased occupancy and operating leverage. Corporate cost is not expected to go up drastically even as SMARTWOR enters new geographies

* GCCs account for over 15% of rental revenue, with management expecting this share to double over the next few years

* Design and fit-out services revenues are expected to scale up meaningfully over near to medium term

* Ancillary revenue to increase by 30–35%, going forward, in line with growing managed office portfolio along with increased occupancy

* OCF-EBITDA to settle at 1.2x on a long-term basis

* Margin growth to outperform the 25–30% revenue growth rate

Valuation Summary and Unit Economics

We employ an EV/Adjusted EBITDA-based valuation framework, wherein the leasing business Adjusted EBITDA is projected using a unitary EBITDA (EBITDA per seat) approach. We assign a 12 month forward EV/Adjusted EBITDA multiple of 15x, based on a timeweighted blend of 4 months of FY26 and 8 months of FY27, arriving at a target price of INR 630 per share — implying a 32% potential upside with a BUY rating.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)