Buy Siemens Energy India Ltd for the Target Rs.3,600 by Motilal Oswal Financial Services Ltd

Expanding capacity, improving margins

Siemens Energy India (ENRIN) reported a strong set of financials for 3QFY25 with 80% YoY improvement in PAT. Revenue growth improved 20% YoY, and EBITDA margin was strong at 19.1% for the quarter, driven by strong margins in the power transmission segment. Based on the 9MFY25 performance and announced capex, we raise our estimates by 3%/9% for FY26/FY27 to bake in improved execution and margin in the power transmission segment. We reiterate our BUY rating with a revised TP of INR3,600 (based on 60x Sep’27E).

Strong set of results

ENRIN reported a strong set of results in 3QFY25. Revenue for 3QFY25 stood at INR17.8b (+20% YoY), largely due to strong YoY growth in power transmission and a strong and healthy order backlog. EBITDA stood at INR3.9b, growing 14% YoY/29% QoQ, while EBITDA margin expanded 470bp YoY to 19.1%. During 9mFY25, the company recorded a provision of INR546m for stamp duty and related charges on property transfers from its parent company (Siemens Ltd.). Adjusting for that, margins were in line with the normalized margin. The company has receivables from Siemens Ltd., which would aid the other income once received. PAT surged 80% YoY to INR2.6b, while PAT margin expanded 490bp YoY to 14.7%. Order inflows increased 94% YoY to INR32.9b, while for the nine months, it stood at INR107.7b. For 9MFY25, revenue/EBITDA/PAT stood at INR51.8b/INR10.3b/INR7.4b, while EBITDA margin stood at 20% (margin of 21% after adjusting the provision for stamp duty and related charges).

Segmental performance

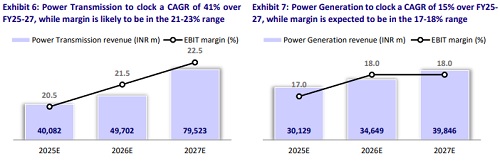

The power transmission segment’s 3Q revenue increased 35% YoY to INR9.8b, while EBIT stood at INR1.8b, leading to 860bp YoY EBIT margin expansion to 18.7%. For 9MFY25, the power transmission segment’s revenue/EBIT stood at INR28.3b/INR5.6b, while the EBIT margin stood at 19.7%. The power generation segment’s revenue rose 6% YoY to INR8.1b, and EBIT increased 6% YoY to INR1.3b, while EBIT margin was broadly flat YoY at 16.2%. For 9MFY25, the power generation segment’s revenue/EBIT stood at INR23.5b/INR4.0b, and the EBIT margin stood at 17.2%.

Ongoing capex for facility upgrades to support financial growth

Earlier, the company had highlighted a capex of INR4.6b for power transformers in Kalwa (doubling capacity from 15,000 MVA to 30,000MVA), INR3.3b for blue GIS in Goa, and INR0.6b for vacuum interrupters in Goa. Along with this, in the current results, the company has announced a capex of INR2.8b in a phased manner in the manufacturing capacity expansion of high-voltage switchgear products at its Aurangabad factory. This expansion will enable the company to meet the growing demand for power transmission equipment, both in India and globally

Financial outlook

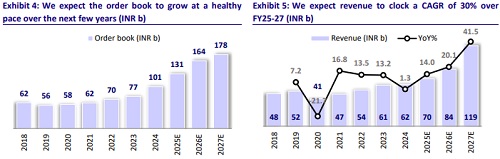

Our assumptions for revenue growth take into account doubling of capacity for transformers and expansion in GIS, along with normal business growth for the turbine business. We revise our FY26/FY27 estimates upward by 3%/9% to factor in 9M performance, announced capex, and improved execution and margin in the power transmission segment. We expect revenue/EBITDA/PAT CAGR of 30%/36%/37% over FY25-27E, led by strong growth across power transmission (41% CAGR) and power generation (15% CAGR). We expect EBITDA margins of 20.3%/21.4%/22.2% for FY25/FY26/FY27.

Valuation and view

ENRIN is currently trading at 80.9x/54.7x P/E on FY26E/27E EPS. We raise our estimates and value the stock at 60x on Sep’27E EPS. We reiterate our BUY rating with a revised TP of INR3,600.

Key risks and concerns

Key risks to our thesis can come from a slowdown in ordering and supply chain issues, thus impacting margin.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412