Buy Safari Industries Ltd for Target Rs3,111 by Elara Capitals

Mass+Class: Power that lasts

Safari Industries (SII IN) changed the way India consumed branded luggage. It is the pioneer of branded travel gear in the mass market category, gaining share from unorganized, unbranded players. Challenging the market leaders and new age D2C players, the company is set on a premiumization journey with a well-diversified portfolio across price points. SII’s thrust on efficient cost structure, distribution expansion and premium product launches should aid margin expansion. Strong thrust on supply chain management, margin expansion and capital allocation are likely to prop free cash flow and increase balance sheet strength. We initiate coverage on SII with a Buy rating and a target price of INR 3,111, based on 35x FY28E EV/EBITDA, offering a 31% upside.

SII leveraging mass market opportunity: SII is the undisputed market leader in India’s pricesensitive mass segment of the luggage industry. Its success stems from price-accessible hard luggage, fast-moving SKUs, and excellent distribution in e-commerce and general trade channels. The company gained market share in an expanding branded segment to reach 32% in CY24 (24% in CY21), featuring among top-three branded companies in luggage industry.

Strategic agility driving growth: Rising preference for premium, and aesthetically appealing luggage led the demand for hard luggage, resulting in industry-wide constraints in hard luggage supply. SII’s sharp pivot towards hard luggage increased its revenue share to 74% in FY25 from 19.4% in FY17. The focus on capacity expansion in hard luggage (favourable cost structure in India), widening distribution channels in both online and offline platforms and single brand strategy underscore SII’s agility in aligning with evolving consumer preferences and premiumization trends.

Set on a premiumization journey: SII’s premiumisation strategy is emerging as a structural growth catalyst, supported by its transition from a single mass brand to a multi-tier portfolio with higher-ASP offerings such as Safari Select, Urban Jungle and Genie. SII is now leveraging its large upgrade-ready customer base, rising discretionary spending and stronger retailer acceptance to drive mix improvement and enhance pricing power. This shift toward premium categories is set to durably lift margins, deepen brand equity, and strengthen SII’s competitive positioning in an increasingly aspirational luggage market.

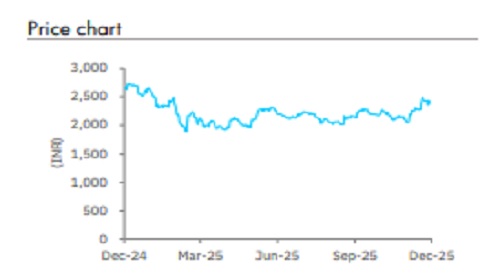

Initiate with Buy: We expect revenue to compound at 16.2% CAGR in FY25-28E, despite increasing competition, led by its strategy to gain market share through product innovation, premiumisation, deeper distribution and a cost-efficient supply chain to lead in mass market segments. We expect EBITDA margin to expand 240bps, enabling an EPS CAGR of 24.8% and ROCE improvement to 22.2% by FY28E. SII has traded at an average one-year forward EV/EBITDA of 25.6x post COVID, with a peak of 48.4x. As the industry recovers from discounting and excess inventory pressures, we expect profitability to recover from FY27E. We initiate coverage with a Buy and a TP of INR 3,111 on 35x FY28E EV/EBITDA, implying 31% upside. Key risks are a change in consumer preference for hard luggage, increase in competitive intensity and sharp rise in raw material price.

Please refer disclaimer at Report

SEBI Registration number is INH000000933