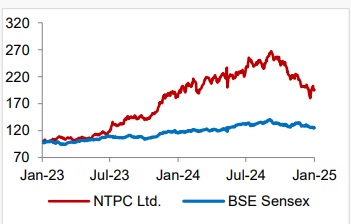

Buy NTPC Ltd For Target Rs.390 by Axis Securities

Strong Q3, Growth Drivers Intact; Retain BUY

Consensus Vs. Actual for Q3FY25: Revenue - MISS; EBITDA - BEAT ; PAT - INLINE

Change in Estimates post Q3FY25 FY25E/FY26E/FY27E: Revenue: -3%/-2%/-1%, EBITDA: -8%/-5%/-3%, PAT: -16%/-12%/-8%

Recommendation Rationale

* Total capacity addition: As of 31st Dec’24, NTPC has a total installed capacity of 76,598 MW. The total under-construction capacity stands at over 30 GW, with thermal projects under construction at 17.6 GW, RE at 10.3 GW and hydro at 2.2 GW. It expects the commissioning of a total capacity of 24.6 GW over FY25-27, with a capacity of ~7/7.7/9.9 GW expected to be commissioned at the consolidated level for FY25/26/27.

* Thermal power projects target of 25 GW: The government plans to add 80 GW of thermal capacity by 2032 to meet the growing power demand. Out of the 80 GW, NTPC will invest in 25 GW. Out of the 25 GW, 17.6 GW is currently under construction and approval for 8 GW is in place. The company is targeting to award 7.2 GW of thermal capacity by FY27. Of the 7.2 GW, NIT has been issued for 2.4 GW and is expected to conclude by the end of FY25. The balance of 4.8 GW will be awarded over the next two fiscal years. The company plans to commission 2.8/1.46/1.46 GW of thermal projects over FY25/26/27.

* NGEL targets: NGEL was listed as a subsidiary on 27th Nov’24. NTPC has an ambitious target of 60 GW of renewable capacity (RE) by 2032. The majority of which will be done through NGEL. The installed RE capacity as of 31st Dec’24 stands at 3,475 MW, with 550 MW of capacity added during 9 months ended Dec’24 and 135 MW added during Q4FY25 till date. NGEL plans to add a further 3,088 MW in Q4FY25 along with its JVs/subsidiaries. It will add 3/5/8 GW of RE capacity over FY25/26/27. The company has complete visibility for the targeted capacity additions with 13.9 GW contracted and awarded capacity supported by firm PPAs. The company has resources in place, and transmission is tied up for targeted additions up to FY25.

Sector Outlook: Positive

Company Outlook & Guidance: NTPC requires Rs 7 Lc Cr of Capex for the 130 GW+ capacity addition by 2032. This will drive growth in regulated equity. Due to its strong vendor network and management, it expects lower execution risk in setting up thermal projects. The coal production target for FY25 is 40 MTPA, and it aims to produce 67 MTPA by FY29.

Current Valuation: We value NTPC using SoTP with the thermal business at 2.0x (from 2.4x) P/BV on FY27 consolidated regulated equity, RE business at CMP (NEGL) after accounting for the 90% stake and considering a 25% Holdco discount, PSP optionality at Rs 23/share, CWIP and cash at 1x P/BV of FY25.

Current TP: Rs 390/share (Earlier TP: Rs 450/Share)

Recommendation: We maintain our BUY rating on the stock

Financial Performance: NTPC reported a strong set of numbers, with EBITDA beating consensus, led by lower other expenses. The consolidated Net sales stood at Rs 45,053 Cr, up 5%/1% YoY/ QoQ, missing the consensus by 3%. Power generation stood at 91.3 BU, up 2%/3% YoY/ QoQ. EBITDA stood at Rs 10,514 Cr, up 20%/17% YoY/ QoQ, beating consensus by 30%, with the EBITDA margins at 30.3%, up 380bps/426bps YoY/QoQ, led by lower other expenses. PAT stood at Rs 5,170 Cr, down 1%/4% YoY/QoQ, beating the consensus by 1%. PAT adjusted for regulatory movements stood at Rs 5,513 Cr, up 46%/81% YoY/QoQ.

Outlook: NTPC’s robust thermal assets provide cash flow visibility. NGEL will unlock the RE business value with its aggressive RE capacity addition targets. We believe NTPC is a good portfolio bet given its stable dividend yield, and a further rerating potential cannot be ruled out if the peak deficits increase in future. We cut our FY25/26/27 Revenue/EBITDA/PAT estimates as we temper down our revenue estimates post Q3FY25. Pickup in RE installation pace will be a key monitorable.

Valuation & Recommendation: We maintain our BUY rating on NTPC. We value NTPC using SoTP with the thermal business at 2.0x (from 2.4x) P/BV on FY27 consolidated regulated equity, RE business at CMP (NEGL) after accounting for the 90% stake and considering a 25% Holdco discount, PSP optionality at Rs 23/share, CWIP and cash at 1x P/BV of FY25. Our Mar’26 TP of Rs 390/share indicates a potential upside of 20% from the CMP

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633