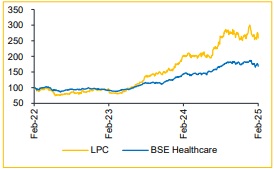

Buy Lupin Ltd For the Target Rs. 2,540 by Choice Broking Ltd

The result came in line with the estimates; New product launches driving the growth

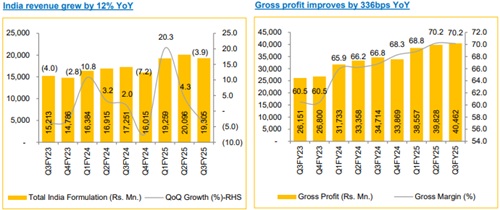

* Revenue came at INR 57.7 Bn (vs. CEBPL est. of INR 57.6 Bn), up 11% YoY and up 1.7% QoQ.

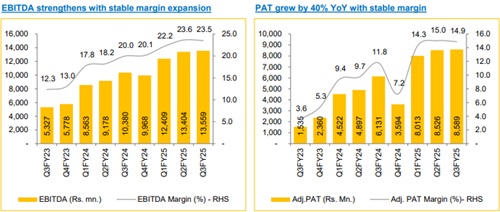

* EBITDA came at INR 13.7 Bn ( vs. CEBPL est. of INR 13.1 Bn), up 33.6% YoY and 4.4% QoQ. EBITDA margin came at 23.5% (vs. CEBPL est. of 22.7%), improved by 354bps YoY but contracted by 12bps QoQ.

* PAT came at INR 8.6 Bn (vs. CEBPL est. of INR 8.4 Bn), up 40.1% YoY and up 0.7% QoQ, with a PAT margin of 14.9% (vs 11.8% in Q3FY24).

India’s business to outperform IPM growth and grow in key therapies like Diabetes and Cardiology

Lupin's India business (~35% of the total revenue) is experiencing robust growth, driven by key therapies and a strong presence in the chronic segment. Chronic therapies like diabetes and cardiology are growing faster than the IPM, with a chronic share higher at 65%. We expect that the acquisition of human insulin products from Eli Lilly and trademarks from Boehringer Ingelheim will further strengthen the diabetes portfolio and support the above-market growth, by innovative medicines, in-licensed products, and a 10,000-person sales force.

Double-digit revenue in the US market is achievable; driven by new product launches

Lupin aims to achieve double-digit revenue growth in the US market (~40% of the total revenue) through strategic new product launches and a focus on complex product development. We expect that this is achievable because of the introduction of products like Tolvaptan, Glucagon, Risperidone Consta, and Liraglutide, strong performance in the respiratory portfolio, increasing the share of complex products to over 50% of its portfolio, and shift from commoditized generics to injectables, respiratory products, and biosimilars

View and Valuation:

We have revised our FY26/27 EPS estimates by 16.3%/13.7%, and maintain our BUY rating with a target price of INR 2,540, valuing at 27x PE on FY27 (earlier 30x, changed due to US uncertainties). We expect Revenue/EBITDA/PAT to grow at a CAGR of 12.7%/21.2%/30.8% over FY24-27. The growth will be driven by strong pipeline of complex generics, injectables, and biosimilars. Strategic launches, including Tolvaptan and specialty products, will enhance profitability. Expansion in global markets, operational efficiencies, and R&D investments in respiratory and biologics will support the growth.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131