Buy JK Tyre & Industries Ltd For Target Rs. 400 By Emkay Global Financial Services

We hosted the management of JK Tyre. KTAs: 1) Demand for CV tyres to improve QoQ in Q4; replacement outlook stays healthy (double-digit CV growth expected in FY26); exports remain relatively resilient despite geopolitical uncertainties. 2) Q3 margin dip due to strategic inventory buildup amid higher RM is seen partially reversing in Q4; RM basket to be largely range-bound in the near term; JKI targets realizing the FY25YTD under-recovery of ~4-5% during FY26 via strategic price hikes, better product mix, and cost reduction. We believe demand revival would be key for margin improvement; we cut FY25E/26E/27E consolidated EPS by 7%/11%/10% respectively given that: a) RM has sustained at higher levels for longer, and b) CV demand recovery has been slower than expected. At 9x FY27E PER, valuations appear reasonable. We maintain BUY while slashing our TP by 20% to Rs400 at 12x FY27E PER (vs 14x Dec-26E earlier). Key stock price catalysts: Fall in RM costs and/or major improvement in CV demand.

Sequential uptick expected in OEMs with healthy replacement demand

CV OEM demand is seen improving sequentially on a benign base as we enter FY26, gaining from: a) higher public infra spends, and b) steady improvement in construction and mining activities. The management highlighted positive replacement demand outlook, including TBR (expects double-digit growth in TBR replacement in FY26 vs 8% growth in 9MFY25). In international markets, EU and Latin America are facing challenges, whereas North America and Middle East are recovering; for JKI, USA revenue exposure at consolidated level is limited to high single digit. Further, the recent ~6% depreciation in Mexican Peso vs USD is seen cushioning JK Tornel’s exports going forward.

Calibrated capacity expansion, new initiatives to aid market share improvement

The ongoing Rs14bn expansion in PCR (~Rs10bn), TBR, and all-steel light truck radials (ASLTR) is on track; FY25 capex guidance stands at ~Rs8bn. JKI aims to consolidate its TBR market share (currently in the 30% range), and foresees PCR revenue share inching up to 35% over the coming years (vs ~5%/29% in FY21/FY24), driven by premiumization-led focus on higher rim size tyres. JKI has undertaken multiple new initiatives in the ‘mobility as a solution’ and tyre pressure monitoring system and is in advanced talks with PV/CV OEMs to embed this software. MAAS margins are in double digits with revenue expected to grow to Rs10bn in 3-4 years (vs Rs1.5bn now). JK Tornel is expanding its exports to North America via new margin-accretive larger tyres.

Aims to offset RM under recovery with calibrated price hikes, better product mix

As per the management, ~9% cumulative price increase is needed to offset the ~13% RM increase seen in FY25YTD; JKI has passed on ~3-4% till now and is hopeful of passing on the remainder in FY26. JKI has undertaken a price increase of ~1-2% thus far in Q4. Current RM basket (~Rs165/kg) is seen remaining range-bound in the near term. Additionally, as per the management, the adverse impact of the strategic inventory buildup seen in Q3 would also be partially reversed during Q4.

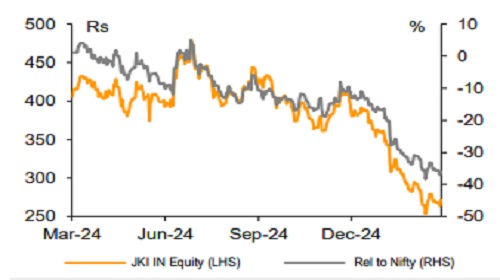

1-Year share price trend (Rs)

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)