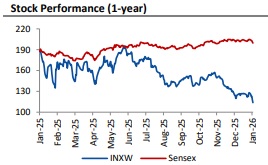

Buy Inox Wind Ltd for the Target Rs. 181 by Systematix Institutional Equities

Steady growth intact; execution pace key to FY26 delivery

We estimate Inox Wind’s (INXW) 3QFY26 consolidated revenue of Rs 14.45bn (+59% YoY, +29% QoQ), based on 270MW order execution during the quarter, increasing by 43% YoY and 34% QoQ. Consolidated EBITDA (excluding other income) is expected to come in at Rs 2.74bn this quarter, up by 35% YoY/21% QoQ. Our estimates imply an EBITDA margin of approximately 19.0% this quarter, as EPC gains momentum. Interest costs are expected to drop by 33% YoY, owing to deleveraging over the last year, resulting in a net profit after tax (before minority interest) of Rs 1,659mn (+49% YoY/+38% QoQ). INXW bagged 302MW orders in 3QFY26, taking the current order book to approximately 2,955MW, net of our estimated execution for the quarter. During the quarter, INXW entered an exclusive memorandum of understanding (MoU) with KP Energy Limited aimed at jointly developing 2.5GW wind and wind-solar hybrid power projects across multiple states in India. KP Energy is a prominent balance-of-plant solutions provider in the renewable energy industry. (BSE)

According to the latest data released by the Ministry of New and Renewable Energy (MNRE), India commissioned 4.47GW of new wind capacity between April and December 2025 itself, notably above 4.1GW installed in FY25. India currently has 54GW of installed wind capacity, representing around 10.6% of total grid capacity, with an additional 30GW under implementation through various renewable energy (RE) procurement frameworks such as wind/solar hybrid, wind/solar integrated with energy storage systems (ESS), and Firm, Dispatchable Renewable Energy (FDRE) tenders. INXW is slated for growth as wind capacity addition gains momentum amidst rising preference for RTC, firm power. We have a BUY rating on INXW, which trades at 27x/17x FY26E/FY27E P/E. Monitoring the execution pace and EPC completions remain crucial, given that customer site readiness to accept equipment deliveries is emerging as a bottleneck.

Above views are of the author and not of the website kindly read disclaimer

.jpg)