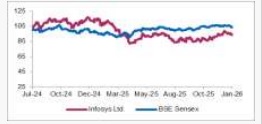

Buy Infosys Ltd For Target Rs. 1,820 By Axis Securities Ltd

Growth Momentum Intact; Revenue Visibility in FY27

Est. Vs. Actual for Q3FY26: Revenue – INLINE; EBIT Margin – INLINE ; PAT – MISS

Change in Estimates YoY post Q3FY26:

FY26E/FY27E: Revenue: 2%/3%; EBIT: 3%/3%, PAT: 1%/-2%

Recommendation Rationale

• Demand Outlook: Management noted that geopolitical uncertainty and tariff negotiations are impacting sectors such as manufacturing, retail, CPG, and communications. However, the company does not foresee any major improvement in the macro environment in the near term.

• Deal Wins/Pipeline: Infosys secured $4.8 Bn in large deals, with 57% being net new. The company is benefiting from vendor consolidation and strength in select pockets, supported by its strong delivery capabilities and AI innovation.

• AI Implementation: The company is witnessing strong AI momentum, with active engagement across 4,600 AI projects involving 90% of its top 200 clients. These initiatives have generated over 28 Mn lines of code and led to the development of more than 500 agents. The company has identified six AI-led value pools for transformation: AI engineering services, data for AI, agents for operations, AI software development and legacy modernization, AI and physical devices, and AI services.

Sector Outlook: Cautiously Optimistic

Company Outlook & Guidance: The revenue guidance for FY26 has been revised to 3%–3.5% growth in constant currency terms, up from the earlier guidance of 2%–3%. Additionally, the company aims to deliver sequential growth, factoring in seasonality and ongoing initiatives, despite the prevailing uncertain environment.

Current Valuation: 23x Dec’27 EPS (Earlier Valuation: 21x Mar’27E EPS)

Current TP: Rs 1,820/share (Earlier TP: 1,620/share)

Recommendation: We maintain BUY rating on the stock

Financial Performance

In Q3FY26, Infosys reported revenue of Rs 45,479 Cr compared with Rs 41,764 Cr in Q3FY25, reflecting an increase of 8.9% YoY and 2.2% QoQ. EBIT stood at Rs 9,479 Cr versus Rs 8,912 Cr in Q3FY25, up 6.4% YoY and 1.3% QoQ, aided by higher other income. EBIT margin declined by 50 bps YoY to 20.8%. Net income came in at Rs 6,666 Cr compared with Rs 6,822 Cr in Q3FY25, registering a decline of 2.3% YoY and 9.6% QoQ, primarily due to exceptional costs related to labour codes. The recurring impact of the new labour laws is expected to be approximately 15 bps on an ongoing basis. In CC terms, revenue grew by 0.6% QoQ and 1.7% YoY. Attrition declined sharply to 12.3% in Q3FY26 from 13.7% in Q3FY25, improving by 140 bps, reflecting a stabilising talent market and improved retention execution.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633