Buy HDFC Bank Limited For the Target Rs.1,170 by Axis Securities Ltd.

Steady Quarter, Growth to Pick Up as Visibility Improves!

Est. Vs. Actual for Q2FY26: NII – INLINE; PPOP – BEAT; PAT – BEAT

Changes in Estimates post Q2FY26

FY26E/27E (%): NII: +0.3/+1.1/+1.9 PPOP: +2.5/+0.4/+0.7; PAT: +3.2/+0.4/+1.5

Recommendation Rationale

* On Track to Accelerate Growth: HDFCB’s credit growth lagged systemic growth, driven by its conscious decision to reduce LDR. With the LDR now <100%, the bank will look to resume its growth journey, with FY26 pegged at par with systemic growth and a further acceleration going into FY27E, outperforming systemic growth. HDFCB’s growth will come from segments where the bank is comfortable lending without diluting its credit standards. The mortgage segment remains a key growth driver for the bank. HDFCB had undertaken corrections in processes, yields, and target market, and since then, the bank has been able to improve volumes and gain market share. Unlike its peers, HDFCB did not tinker with mortgage rates, as it did not fit into its risk-reward framework. The bank has also seen signs of growth revival in the SME segment. The management expects a healthy growth pick-up in the segment by leveraging its footprint and clientele, without compromising on asset quality. HDFCB will also look to explore opportunities in cross-border transactions, given the large market opportunity available amongst its customer base. With economic activity picking up and HDFCB looking to accelerate its credit growth momentum, we expect the bank to deliver a healthy ~15% CAGR credit growth over FY26-28E.

* NIM to Improve Hereon: In Q2, the bank’s NIMs contracted by 8bps QoQ, aided by a 20bps reduction in CoF, while the yield contraction was sharper at ~30bps QoQ. The management has indicated that a bulk of the asset repricing is behind, and NIMs should benefit from the downward repricing of TDs. The rate cut actions taken by the bank have been reflected in SA rates. However, given the longer duration of TDs, the repricing benefit has yet to fully reflect. However, the management is confident exiting FY26 with better NIMs vs Q2. We expect NIMs to improve to 3.8% over FY27-28E vs 3.6% in FY26E.

* Focus on Granular Deposit Growth: HDFCB’s focus remains on building a granular retaildominated deposit base, while exercising a pricing discipline. The bank will look to source granular deposits by leveraging its branch network and is comfortable growing at ~15% YoY on an average deposit basis in FY26. The bank will now particularly focus on mobilising CASA deposits by upselling to its mortgage customers, as a savings account is attached to every home loan.

Sector Outlook: Positive

Company Outlook: HDFCB has been consistently performing on its guidance in its endeavour to revert to its pre-merger levels across metrics, and its execution capabilities remain strong. With LDR at a <100% level, the bank will look to accelerate growth momentum in FY26 to match systemic growth. Further acceleration of growth in FY27E, while maintaining a strong deposit growth momentum, should enable HDFCB to bring down its LDR to sub-90%. The margin compression seen in H1 is expected to reverse going into H2, supported by deposit repricing and CRR cut driving exit margins higher. The NIM pressures would be adequately offset by controlled Opex and benign credit costs, enabling HDFCB to deliver RoA/RoE of 1.8-1.9%/15-16% over FY26-28E.

Current Valuation: 2.6x FY27E ABV; Earlier Valuation: 2.5x FY27E ABV

Current TP: Rs 1,170/share; Earlier TP: Rs 1,150/share

Recommendation: We maintain our BUY recommendation on the stock.

Alternative BUY Ideas from our Sector Coverage: ICICI Bank (TP – Rs 1,650/share)

Financial Performance

* Operational Performance: HDFCB’s advances (net) grew by 10/4% YoY/QoQ. Retail grew by 7/2% YoY/QoQ, CRB by 17/4% YoY/QoQ, and Corporate grew by 6/5% YoY/QoQ. Deposits growth trailed credit growth, registering a growth of 12/1% YoY/QoQ. CASA Deposits growth was muted at 7/1% YoY/QoQ, with CA deposits de-growing by 1% QoQ and SA deposits growing at ~2% QoQ. CASA ratio stood at 33.9%, flat QoQ. TDs grew by 15/1% YoY/QoQ. C-D Ratio inched up to 97% vs 96% QoQ.

* Financial Performance: NII grew by 5%/flat YoY/QoQ, on an advances growth of 7/2% YoY/QoQ, with *core NIMs (calc.) declining merely by 3bps QoQ. NIMs (calc. on IEA) stood at 3.32% vs 3.35% QoQ. Non-interest income growth was better-than-expected at 25% YoY (QoQ will not be comparable as it included stake sale gain in HDB). Fee income growth was strong at 9/16% YoY/QoQ. Treasury income stood at Rs 23.9 Bn vs Rs 2.9 Bn YoY. Opex growth was controlled and grew by 6/3% YoY/QoQ. C-I Ratio stood steady at 39.2% vs 39.6% QoQ (barring one-time impact of the stake sale). PPOP grew by 13% YoY. Credit costs (calc.) stood at 52bps vs 57bps (ex one-time impacts) QoQ. PAT grew by 11/3% YoY/QoQ.

* Asset quality: GNPA/NNPA improved to 1.24/0.42% vs 1.4/0.47% QoQ. Slippages declined QoQ, with the slippage ratio at 1.1% vs 1.4% QoQ.

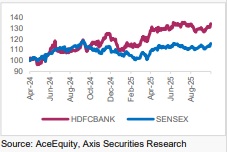

Relative Performance

Key Takeaways

Prudent Capital Utilisation: HDFCB remains well capitalised with CRAR/Tier I at 20.0/17.9% as on Sep’25. The recent draft proposals seem to suggest a meaningful reduction in risk-weighted assets and should release capital. The bank’s capital consumption was lower in FY25, owing to the conscious pullback in growth. However, with the bank now looking to accelerate credit growth to match systemic growth and further accelerate it in FY27E, the capital consumption would be higher. Moreover, as the bank accelerates growth in the retail segments, the capital requirement would be higher.

Outlook

With the LDR below 100% and the trajectory in line with the bank’s intent to bring it down to pre-merger levels over the medium term, we expect credit growth to pick up in FY26 and mirror systemic credit growth. NIMs are expected to have bottomed out, and TD repricing and a CRR cut should support margin expansion going into H2. HDFCB’s earnings growth is likely to be driven by (a) improving cost ratios driven by better productivity and efficiency, (b) controlled credit costs on the back of strong asset quality, and (c) Gradual improvement in NIMs with deposit repricing playing out. We expect HDFCB to deliver a 15/18/17/18% CAGR Credit/Deposit/Earnings growth over FY26-28E, while delivering RoA/RoE of 1.8-1.9%/13-15% over the same period. We broadly maintain our FY27-28E estimates with minor tweaks.

Valuation & Recommendation

We value the core book at 2.6x FY27E ABV vs. its current valuation of 2.2x FY27E ABV (on core book) and assign a value of Rs 135/share to subsidiaries, thereby arriving at a target price of Rs 1,170/share, implying an upside of 17% from the CMP. We maintain our BUY recommendation on the stock.

Key Risks to Our Estimates and TP

* The key risk to our estimates remains a slowdown in overall credit momentum owing to the bank’s inability to ensure deposit mobilization, which could potentially derail earnings momentum for the bank.

* Slower substitution of higher-cost debt with lower-cost deposits could continue to hurt margins

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633