Buy Entertainment Network India Ltd For Target Rs. 270 By Elara Capital Ltd

Muted FCT revenue drags show

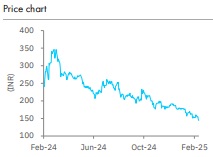

Entertainment Network (ENIL IN) posted a muted Q3 on revenue decline in Free Commercial Time (FCT) of 4.0% YoY even as non-FCT grew 21.5% YoY. EBITDA margin took a hit on elevated production cost, and this may persist, as it aims to rely on nonFCT for overall growth. Hence, we cut our EBITDA estimates by 5.9% for FY26E & 7.2% for FY27E and arrive at a lower TP of INR 270 based on a SOTP valuation as we roll forward to FY27E. The stock has declined by 21% in the past three months. Calibrated cost in non-FCT and pickup in FCT may bolster margin. We reiterate Buy.

Muted private ad and lower government ad impact FCT:

FCT revenue declined by 4% YoY, driven by contraction in advertising spend across sectors and lower election-led government ad vs the past year. Ad spend in consumer durables, FMCG, apparels, and the real estate sectors was muted, and there was a slight uptick from auto, pharma, and jewelry sectors. FCT revenue was at ~75-80% of pre-COVID, with radio yield showing QoQ stability but remaining 25% below pre-COVID. In 9MFY25, FCT revenue fell 9.0% YoY, and management does not see any material surge in Q4. Hence, we expect a 1% YoY revenue decline in FY25E and revenue growth of 2% each in FY26E & FY27E.

Healthy growth in non-FCT revenue:

Non-FCT sailed for ENIL in Q3. The segment’s solutions and events business delivered 21.5% YoY growth, and ENIL remains confident on continuing robust performance in Q4; hence, we expect FY25E to post 13.0% YoY revenue growth. It is focused on diversifying revenue streams to become a multimedia company. The out-of-home segment, (concerts and events), benefits from tailwinds on increased customer interest. We expect a revenue CAGR of 11.0% during FY24-27E.

Gaana to break-even in the next six quarters:

Despite a price hike in July 2024, Gaana sustains solid traction and holds a 15-20% market share in paid music streaming industry in India, per ENIL. FY26E can see full reflection of the increased pricing. Investment in Gaana also declined 15% YoY to INR 128mn. ENIL expects to break-even in the next six quarters. It expects Gaana to clock in revenue of INR 600mn by endFY25; we expect Gaana to report a revenue CAGR of 12.5% during FY26-27E.

Elevated production expenses hurt gross margin:

Elevated production expenses pertaining to non-FCT dragged EBITDA margin by 958p YoY in Q3. With ENIL aiming for growth in the segment, which could weigh on margin, we trim EBITDA margin by 30-40bp during FY26-27E.

Retain Buy with a lower TP of INR 270:

Amid a muted outlook in the radio segment, non-FCT would drive growth for ENIL, which may pare down EBITDA margin due to higher production-related expenses. Hence, we cut EBITDA by 6-7% during FY26-27E. Rolling forward to FY27E, we value FCT at 5.0x (from 6.0x) EV/EBITDA, 2.0x (unchanged) EV/EBITDA for non-FCT and 2.0x (unchanged) EV/sales for the digital and Gaana segments; We lower our SOTP-based TP of INR 270 from INR 300. Calibrated cost in non-FCT and a pickup in FCT may support margin. We reiterate Buy.

Please refer disclaimer at Report

SEBI Registration number is INH000000933