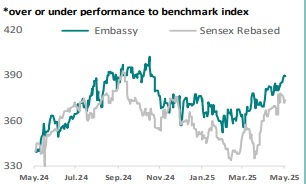

Buy Embassy Office Parks REIT for Target Rs. 425 by Geojit Financial Services Ltd

Double dight growth guidance in distributions….

Embassy Office Parks REIT is India’s first and largest publicly listed Real Estate Investment Trust, which owns and operates a 51msf commercial portfolio, apart from its hotels and solar plant.

• In Q4FY25, Embassy reported 15% YoY revenue growth supported by better occupancies (85% in Q4FY24 v/s 87% in Q4FY25) and strong rental escalations.

• Distributions for the quarter stood at Rs. 5.68, marking 9% YoY growth.

• The total leasing for the quarter was ~1.6msf spread across 31 deals, which include 1.3msf new leasing and 0.3msf renewal.

• The completed commercial portfolio jumped to 40.3msf (36.5 in Q4FY24) with significant improvement in WALE to 8.4 years from 6.8 years, on a YoY basis.

• The mid-point DPU guidance for FY26 is at Rs. 25.25, implying a growth of 10% YoY.

• Looking ahead, Embassy’s 6.1msf under construction projects coupled with better outlook occupancies and rental escalations are expected to sustain the distribution growth.

Outlook & Valuation

In FY25, Embassy office parks demonstrated strong performance in terms of both operations and distributions. Looking ahead, Embassy is well positioned to sustain its topline and distribution growth, supported by (1) an addition of ~3msf leasing area in FY26, (2) better occupancies, +300-400bps guidance, (3) potential rental escalations, and (4) a positive outlook on the Indian commercial sector. Currently, the stock trades at an attractive 7.2% yield to FY27E DPU (the 5-year average is 6.1%). Hence, we upgrade our rating on the stock to BUY with a target price of 425 based on 15.2x FY27E DPU, implying a TER of 15% (~6.5% distribution yield and ~9.3% capital appreciation).

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

.jpg)