Buy Coal India Ltd For Target Rs.440 by by Axis Securities

Adj. EBITDA Miss; Growth Outlook Moderates

Est. Vs. Actual for Q3FY25: Revenue – INLINE; Adj EBITDA – MISS; PAT – MISS

Change in Estimates post Q3FY25 Result

FY25E/FY26E: Revenue: -4%/-8%; Adj. EBITDA: -6%/-22%; Attrib. PAT: -3%/-17%

Recommendation Rationale

* Adj EBITDA (exl. stripping activities) missed our estimate by 9% and stood at Rs 10,405 Cr (down 13% YoY/ up 45% QoQ), led by higher contractual expenses, partially offset by lower employee expenses.

* E-auction premium stood better than our estimate at 76% (vs. our est. of 53%) and as compared to 69% in Q2FY25. ASP stood at Rs 1,667/t (down 4% YoY/ up 3% QoQ). It missed our and consensus estimates by 2%/7%, respectively. While e-auction prices stood at Rs 2,671/t, exceeding our assumption of Rs 2,350/t, the FSA price missed our estimate slightly by 1% at Rs 1,514/t (down 1% YoY, but up 4% QoQ).

* E-auction volumes grew YoY/QoQ but stood below our estimate at 19 MT (up 22%/28% YoY/QoQ) at 10% of total sales volume (against the company’s target of 15%) vs. our estimate of 25 MT.

* Volume growth moderates: CIL’s 9MFY25 coal offtake grew by only 1.5% YoY to 561 MT as power demand growth moderated to 4.4% YoY in 9MFY25 (post 8% YoY growth in FY24). To achieve its coal offtake target of 838 MT for FY25, Q4 sales volume needs a steep 37% YoY increase. We now revise our FY25/26 coal offtake volumes to 777/823 MT (vs an earlier estimate of 800/870 MT). CIL has a coal production target of 1 BT by FY27, but we model lower offtake at 870 MT (vs earlier projection of 925 MT), anticipating rising captive coal share and lower thermal PLFs.

Sector Outlook: Cautiously positive

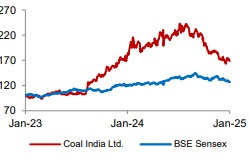

Company Outlook & Guidance: Post the recent slackening of coal offtake, we trim down our sales volume assumption by 5%/6% for FY26/27. Focus on captive coal growth and lower thermal PLFs as RE capacity picks up in coming years, may slow down coal offtake requirements. Captive coal percent of total coal production has increased to 15% in FY24 at 154 MT from 9% in FY20 (the government plans to achieve 20% captive coal out of 1.5 Bn T coal production target by 2030). We trim our FY26/27 EBITDA estimates post Q3 numbers as we cut our coal offtake assumptions, but retain BUY as we roll forward our valuation to Dec’26 from Sep’26. Also, post the recent price correction, the valuations are not very demanding (trading at 4.4x our FY27 adj EBITDA) and offer a dividend yield of 6%. Volume ramp-up in FY26/27 will be the key monitorable.

Current Valuation: 6.0 x EV/EBITDA on Adj. Dec’26E EBITDA (From Sep’26)

Current TP: Rs 440/share (Earlier TP: Rs 520/share)

Recommendation: We retain the BUY rating after the recent price correction.

Financial Performance: CIL’s Adj. EBITDA (exl. stripping activities) stood at Rs 10,405 Cr (down 13% YoY/up 45% QoQ), a 9% miss vs. our estimate led by higher contractual expenses partially offset by lower employee expenses. Contractual coal production increased by 6% YoY to 132 MT in Q3FY25. Revenue stood broadly in line with our estimate at Rs 35,780 Cr (down 1% YoY/ up 17% QoQ). Attributable net profit declined by 17% YoY, but grew by 35% QoQ (Q2FY25 is seasonally weak), missing our estimate by 9% led by higher D&A expense. D&A expense increased by 46%/32% YoY/QoQ, 34% ahead of our estimates, led by an impairment charge of Rs 758 Cr of stripping assets at NCL. The company declared a 2 nd interim dividend for FY25 of Rs 5.6/sh after its 1st interim dividend of Rs 15.75/share declared in Nov’24

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633