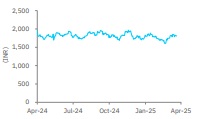

Accumulate Dalmia Bharat Ltd For Target Rs. 2,133 By Elara Capital

Operating leverage bolsters margin

Dalmia Bharat (DALBHARA IN) reported a QoQ improvement of INR 161 in EBITDA/tonne. This uptick was primarily driven by benefits of operating leverage, and ~28% QoQ increase in volume despite net realization being flat QoQ and variable production cost rising slightly by ~2% QoQ. While the recent increase in petcoke prices and imposition of a tax on limestone in Tamil Nadu are likely to raise cost, the rise is likely to be more than offset by cement price hikes in the past four weeks. Further, the company's planned capacity addition is setto support future growth, potentially resulting in improvement in valuation premium as the growth narrative strengthens. Thus, we reiterate Accumulate with a higher TP of INR 2,133 based on 11x March 2027E EV/EBITDA.

Termination of JPA Group tolling arrangement hurts YoY volume growth: Sales volume dropped ~3% YoY but rose ~28% QoQ to ~8.6mn tonne. The YoY decline in volume is primarily attributed to discontinuation of the tolling arrangement with Jaiprakash Associates (JPA); excluding JPA, volume growth stood at ~4% YoY. Blended realization dipped ~2% YoY but remains flat QoQ to INR 4,777/tonne as cement prices in Odisha remain range-bound and under pressure in South India. Operating cost declined ~7% YoY and ~4% QoQ to INR 3,851/tonne, primarily led by operating leverage benefit. Thus, EBITDA/tonne increased ~24% YoY and ~21% QoQ to INR 926 vs our estimates of INR 873

Announces new growth capex: In Q4FY25, DALBHARA added 2.4mn tonne of cement capacity at Lanka (Assam) and 0.5mn tonne at Rohtas (Bihar), taking total cement capacity to 49.5mn tonne by end-Q4FY25. Further, ongoing clinker expansion of 3.6mn tonne in Assam is expected by Q2FY26, taking clinker capacity to ~27mn tonne by FY26. The company has announced new expansion projects with a capex of INR 35.2bn, comprising: 1) a Brownfield clinker and cement expansion of 3.6mn tonne and 3.0mn tonne, respectively, at Belgaum (Karnataka), and 2) a 3.0mn tonne Greenfield split grinding unit at Pune (Maharashtra). These projects are likely to be completed by end-FY27, resulting in a rise in cement and clinker capacity to 55.5mn tonne and 30.7mn tonne, respectively.

Reiterate Accumulate with a higher TP of INR 2,133: We believe the recent increase in cement prices is a positive development for the industry, provided these hikes sustain. Further, the ramp-up of newly added capacity is likely to drive volume growth. While the recent rise in pet coke prices is cause for concern, management’s ongoing cost control efforts, including a targeted cost reduction of INR 150-200/tonne for the next two years augur well. In the near term, the newly announced growth capex along with potential new capex announcement in the next quarter should provide more growth visibility. Thus, we reiterate Accumulate. We raise our EBITDA by ~9% for FY26E and ~4% for FY27E and introduce FY28 estimates. Thus, our TP stands raised to INR 2,133 from INR 2,023 on 11x (unchanged) March 2027E EV/EBITDA. Sub-par demand, weak cement prices and a sharp rise in fuel prices are the key risks to our call.

Please refer disclaimer at Report

SEBI Registration number is INH000000933