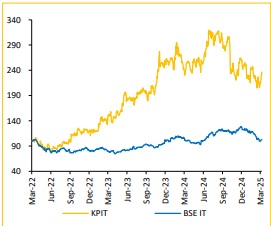

Buy KPIT Technologies Ltd For the Target Rs. 1,707 by Choice Broking Ltd

Analyzing Q3 Results amid Trump Tariffs & Macroeconomic Challenges

KPITTECH reported in-line performance on all fronts

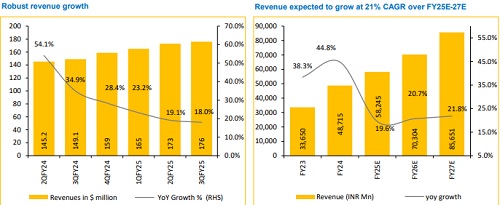

* Revenue for Q3FY25 came at INR 14.7Bn up 17.6% YoY and 0.4% QoQ (vs consensus est. at INR 14.8Bn).

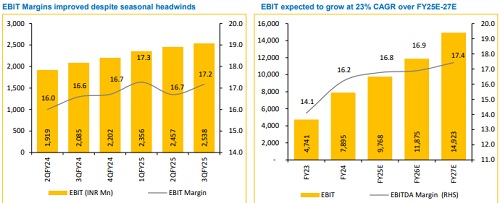

* EBIT for Q3FY25 came at INR 2.5Bn, up 21.7% YoY and 3.3% QoQ (vs consensus est. at INR 2.5Bn). EBIT margin was up 58bps YoY and 47bps QoQ to 17.2% (vs consensus est. at 16.8%).

* PAT for Q3FY25 stood at INR 1.9Bn, up 19.3% YoY but down 8.2% QoQ (vs consensus est. at INR 1.9Bn).

TCV sees 20% sequential growth, securing new engagements worth $236Mn:

In Q3FY25, KPIT achieved strong performance, securing new engagements with a TCV of $236Mn. These wins were geographically balanced, with Europe leading, followed by US and Asia. KPIT’s strategic focus on autonomous driving, connected domains, and electric powertrains led to significant wins. A top European carmaker chose KPIT for autonomous projects, while another partnered for electric powertrains. KPIT also secured major contracts with an American OEM and a prominent Asian carmaker. KPIT’s deal pipeline grew by 20% QoQ in Q3FY25, highlighting strong future opportunities. This growth is driven by key deals and a diverse client base across sectors like Passenger Cars, Off-highway, Commercial Vehicles, and semiconductors. The rising demand for Software Defined Vehicles (SDV), fuelled by architectural changes and OEM consolidation, further boosts KPIT's prospects. Increased interest from T25 clients in vehicle cost reduction, cybersecurity, and data-driven services added to the momentum. With a positive management outlook, KPIT is poised for continued expansion in Europe, the US, and Asia, contingent on regional economic conditions. Strategic partnerships with semiconductor firms present additional growth avenues, while potential mergers like Honda and Nissan’s, could offer new opportunities, though merger talks were scrapped in Feb2025, as both cited significant challenges.

FY25 EBITDA margin guidance rose to 21%+; Attrition hits all-time low:

KPIT has raised its EBITDA margin guidance for FY25 to 21%+, reflecting a strong Q3FY25 margin of 21.1%, marking both sequential and YoY improvements. This profitability boost is driven by enhanced productivity, a favorable revenue mix, and efficient cost management. The company also reports all-time low attrition, approx. half the industry average. While headcount slightly decreased in Q3FY25, revenue growth is primarily due to higher productivity, not workforce expansion. KPIT is focusing on up skilling its talent in AI and selectively hiring to address future needs. Additionally, the company is exploring talent acquisition in lower-cost regions while emphasizing improved revenue per employee, which rose from $56,558 in Q2FY25 to $58,992 in Q3FY25.

Potential slowdown in IT spends amid Trump tariffs poses risk for KPIT:

The Company may face revenue challenges due to the uncertainty surrounding decisions on Trump-era tariffs, which could affect auto companies in Europe and, indirectly, impact KPIT's top-line. With approx. 30% of its revenue coming from the US and around 50% from Europe, any reduction in IT spending or delays in contract renewals in key sectors could impact growth. Currency volatility also poses margin risks. However, a stable tariff environment and clearer tariff decisions could help boost demand.

View and Valuation:

KPIT retains its CC revenue growth guidance for FY25E to 18-22%. The significant increase in the deal pipeline also suggests a positive outlook for future revenue generation. Given these factors we expect Revenue/ EBITDA/ PAT to grow at a CAGR of 21.3%/ 23.4%/ 20.7% respectively over FY25EFY27E. We continue to maintain a BUY rating, but have revised our target price downwards to INR 1,707 owing to weaker assumptions. This adjustment is based on lowering the PE multiple to 40x (earlier 48x) amid broad market correction based on FY27E EPS of INR 42.7.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131