Buy Axis Bank Ltd For Target Rs. 1400 By Yes Securities Ltd

Our view – Provisioning policy and focus on liability granularity and RaROC demonstrate conservativeness

Asset Quality – Gross slippages rose on sequential basis due to seasonality and stress on unsecured retail:

Gross NPA additions amounted to Rs 54.32bn for 3QFY25, translating to an annualized slippage ratio of 2.1% for the quarter. Gross NPA additions had amounted to Rs 44.43bn during 2QFY25. A dominant part of the slippages for 3Q emerged from the personal loans and credit cards book. Most of the sequential rise in gross slippages amounting to Rs 9.89bn comes from seasonality pertaining to agri loan slippages. Reported net credit cost amounted to 80 bps for the quarter. The bank provides 100% on retail unsecured NPLs or linked loans on day 1 itself or 91 dpd, which is a tighter provisioning policy than several peers. Consequently, the credit cost for the bank would be higher than other banks in the initial quarters in the current cycle.

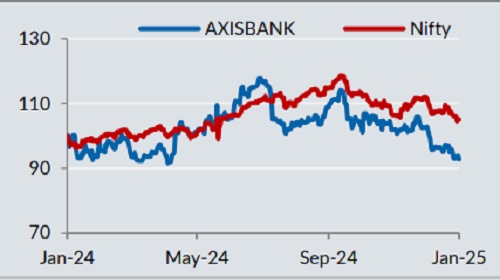

Stock performance

Net Interest Margin – Margin declined 6 bps sequentially largely due to non-structural reasons:

NIM was at 3.93%, down -6bps QoQ and -8bps YoY. Of the decline of -6bps QoQ, around -3bps is attributable to full impact of application of increased outflow rates on operating deposits coupled with higher LCR and the balance -3bps impact was due to interest reversals. The 3.8% NIM guidance through the cycle still stands.

Balance sheet growth – Both loan and deposit growth have slowed incrementally owing to conservativeness:

The advances for the bank stood at Rs 10,146 bn, up by 1.5% QoQ and 8.8% YoY. The deposits were at Rs 10,959bn, up by 0.8% QoQ and 9.1% YoY. While period-end deposit balance has grown slower, the quarterly average balance (QAB) has grown 13% YoY, which is better than the industry. The advances for the bank stood at Rs 10,146bn, up by 1.5% QoQ and 8.8% YoY. The bank does not want to grow at any cost and is focused on RaROC.

We reiterate BUY rating on AXSB with a revised price target of Rs 1400:

We value the standalone bank at 1.9x FY26 P/BV for an FY25/26/27E RoE profile of 15.4%/15.2/14.6%. We assign a value of Rs 171 per share to the subsidiaries, on SOTP.

Other Highlights (See “Our View” above for elaboration and insight)

* Opex control: Total cost to income ratio was at 46.2% down by -79/-326bps QoQ/YoY and the Cost to assets was at 2.4% down by -17/-23bps QoQ/YoY.

* Fee income: Core fee income to average assets was at 1.4%, down -4/- 7bps QoQ/YoY.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632

.jpg)