Buy APL Apollo Tubes Ltd For Target Rs. 1,984 By Yes Securities Ltd

Stellar performance amidst the ongoing challenging environment, upgrade earnings and maintain our BUY rating!

Result Synopsis

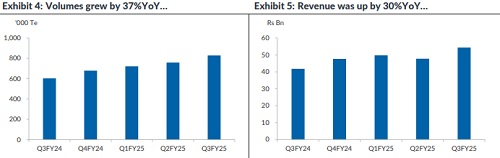

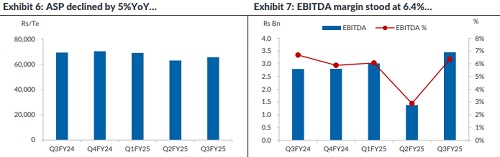

Amidst the ongoing slowdown in overall macro spends, APL Apollo Tubes’ (APAT) sales volume growth of 37%YoY in Q3FY25 & 19%YoY growth in 9MFY25 displays company’s dominant position in structural steel tubes industry. The growth has been on the back of shift in demand from secondary to primary steel as the price difference between the two has narrowed down, and company’s discounting policy to push volumes and gain market share. Despite the same, General products share to total volumes declined marginally to 44% Vs 45% in Q2FY25. Post, the severe dent on profitability in Q2FY25, APL’s EBITDA/Te came in at Rs4,173/Te for Q3FY25. However, higher discounts and increase in other expenses capped the revival in profitability. Other expenses were higher due to increase in freight cost by Rs150Mn, Rs50Mn incremental power cost, and rise in plant operational cost by Rs100-150Mn.

Management Guidance

Management is on-track to deliver 3.1-3.2MnTe volumes for FY25E and company has maintained their guidance of 4Mn/5MnTe volumes by FY26E/FY27E respectively. Moreover, despite the drag in profitability in Q2FY25, company expects absolute EBITDA for FY25E to be higher Vs FY24 (i.e. ~Rs4,500/Te profitability in Q4FY25E).

Our View

We expect APL to deliver a volume CAGR of ~19% over FY24-FY27E, with improvement in macro environment, shift in demand towards primary steel, and rampup of Dubai & Raipur operations. Hence, we expect company’s sales volume to come in at 4.41MnTe (Vs guidance of 5MnTe) by FY27E. Incrementally, growing application of APL products (in solar and other segments) and new up-coming capacities, we reckon volumes to accelerate. Moreover, with stability in HRC prices, expected rampup of Dubai & Raipur plant (higher share of VAP), and rolling-back of on-going discounts should enable APL to register EBITDA/Te of Rs4,500/Rs4,600 for FY26E/FY27E (Vs guidance of Rs5,000/Te by FY27E).

We have revised our EPS estimates upwards by 10%/6%/6% for FY25E/FY26E/FY27E respectively. At CMP, the stock trades at P/E(x) of 32x on FY27E revised EPS of Rs49.6 (nearly doubling from FY24 EPS). We continue to value APL Apollo Tubes at P/E(x) of 40x on FY27E EPS, on the back of higher growth and bottoming-out of profitability. Hence, we retain our BUY rating on the stock with target price of Rs1,984.

Result Highlights

* Revenue stood at Rs54.33Bn, a growth of 30%YoY (8% above our est and 5% above consensus est).

* Volumes (as mentioned in quarterly press release), were up by 37%YoY to 828KTe.

* ASP came in at Rs65,597/Te an improvement of 4%QoQ and decline of ~5%YoY.

* EBITDA/Te came in at Rs4,173 Vs our est of Rs4,100 and as compared to Rs4,636/Te in Q3FY24 & Rs1,821/Te in previous quarter which was severely dented by inventory losses.

* PAT stood at Rs2.17Bn, a growth of 31%YoY.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632