Bullion retreats from record high as traders await FOMC meeting - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

* Bullion pulled back from its record high during the late evening session on Tuesday as traders adopted a cautious approach ahead of the highly anticipated FOMC meetings. Additionally, speculators "took profit following the recent rally," contributing to the decline in bullion prices from their peak.

* Data released on Tuesday indicated that U.S. retail sales rose more than anticipated in August. However, a weakening labor market and increasing prices due to tariffs present a downside risk to the ongoing strength of consumer spending.

* Crude oil has seen gains for the third consecutive day as traders evaluate the repercussions of Ukrainian attacks on Russian crude infrastructure. At the same time, the European Union is considering sanctions against companies in India and China that are facilitating Russia's oil trade. This move is part of an upcoming package of new restrictions aimed at pressuring Vladimir Putin to negotiate an end to the conflict.

* Natural gas rose by nearly 2.0% on Tuesday due to weather forecasts indicating that higher-than-normal temperatures will last longer into September than previously expected.

* Copper reversed its gains and closed lower on Tuesday, influenced by expectations of increased supply. Chile, the leading copper producer, anticipates that national output will rise this year and next, with a target of reaching a record 6 million tons by 2027. This forecast comes despite ongoing challenges at Codelco’s flagship mine and disruptions affecting Teck Resources’ operations.

* The U.S. central bank is expected to deliver a quarter-percentage-point rate cut later in the day to support the labor market. Investors will closely monitor Fed Chair Jerome Powell's remarks and the Fed's quarterly Summary of Economic Projections, which includes the "dot plot" outlook for the future policy path.

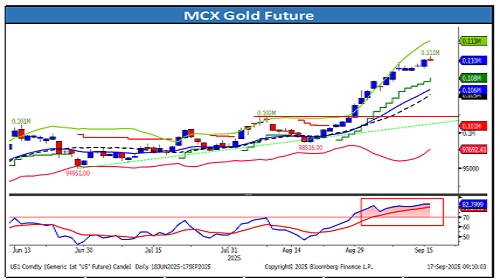

Gold

* Trading Range: 108450 to 110080

* Intraday Trading Strategy: Sell Gold Mini Oct Fut at 109925-109950 SL 110380 Target 109425/108950

Silver

* Trading Range: 125680 to 129500

* Intraday Trading Strategy: Sell Silver Mini Nov Fut at 128050-128075 SL 129150 Target 127125/126600

Crude Oil

* Trading Range: 5515 to 5725

* Intraday Trading Strategy: Sell Crude Oil Sep Fut at 5675-5680 SL 5725 Target 5625/5588

Natural Gas

* Trading Range: 265 to 282

* Intraday Trading Strategy: Sell Natural Gas Sep Fut at 277 SL 282.80 Target 269/267

Copper

* Trading Range: 897 to 919

* Intraday Trading Strategy: Sell Copper Sep Fut at 912-912.5 SL 917 Target 905.80/903

Zinc

* Trading Range: 275 to 284.8

* Intraday Trading Strategy: Sell Zinc Sep Fut at 283-283.5 SL 287.0 Target 279.0/277.80

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133