Building Materials - Q1FY26 Result Review by Choice Institutional Equities

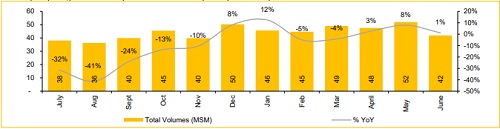

Morbi Export Sales

Morbi tile export sales were down by 11% in FY25 to 180Bn, due to week global demand and higher freight rates and it further decreased by 1% in Q1FY26 to 47.5Bn vs 47.7Bn in last year same quarter. For June Month export sales came in at INR 14.2Bn down 18% MoM. We expect pricing situation to improve as tiles demand picks up in both export and domestic markets.

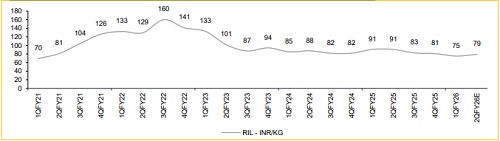

PVC Price Volatility

PVC prices rose 3% in FY25 to INR 86/kg, but declined in 1QFY26 to INR 75/kg, down 17% YoY and 7% QoQ. In Q2FY26E, prices recovered by INR 4.5/kg to INR 81/kg, a 5% QoQ increase. The ADD on PVC resins is expected by Oct–Nov’25, following a DGTR investigation notice. If implemented, it could lift prices by 5–10% and support healthier channel stocking.

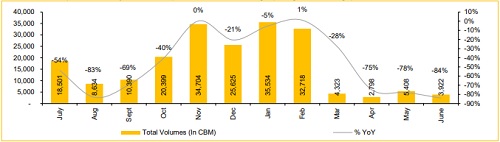

MDF Imports

After BIS came into effect on 11th Feb 2025, MDF imports dropped sharply. In June 2025, imports fell ~84% YoY and 27% MoM to 3,922 CBM. For Q1FY26, imports were down 80% to 12,128 CBM compared to 60,371 CBM last year. With cheap imports now under control, Indian MDF companies are likely to see better plant utilization and stronger pricing in the coming quarters.

Good Q1 for Tiles, Bathware, MDF; Pipes Disappointed

Our Building Materials coverage companies have exposure to Plastic Pipes, Bathware, Tiles, Plywood & MDF segments. Pipes segments reported volume de-growth mainly due to early monsoon & company specific reasons, Bathware reported a revenue growth of 4% and Plywood segment volume de-grow by 3% whereas MDF segment saw a volume growth of 8%. Tiles segments performance of SOMC was better when compared to its peers.

In Q1FY26, the Plastic Pipes industry posted 2% YoY volume growth, below expectations due to extended monsoons and weak infra spending. HINDWARE pipes segment and APOLP performance was below industry with -21/-5% de-growth respectively in volumes, Realizations dipped 7% YoY to INR 129/kg. EBITDA/MT for HINDWARE and APOLP declined 18/25%YoY due to higher costs. HINDWARE’s Roorkee expansion remains on track, adding 12,500 MT, while APOLP plans INR 4,000Mn capex to reach 286 ktpa by FY27E.

In Bathware segment, HINDWARE’s revenue grew by 5% YoY with margins improvement of 30bps, whereas SOMC’s revenue grew 4%.

Tiles demand stayed modest with SOMC’s volume/revenue growing by 3.0/4.5% YoY.

MTLM reported 3% YoY volume de-growth in Plywood, whereas better realization led to margin expansion of 10bps to 7.9%. In the MDF segment, reported a volume growth of 8.5% on the back of lower imports and anticipation of BIS implementation, realizations grew 3% YoY to INR 31,763/CBM driven by a better product mix. EBITDA margins improved by 80bps to 17.4%.

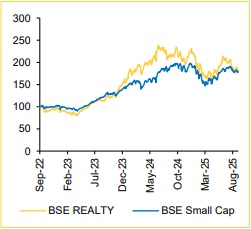

Rebased Price Chart

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131