Banking Rate Tracker - April 2025 by CareEdge Ratings

Synopsis

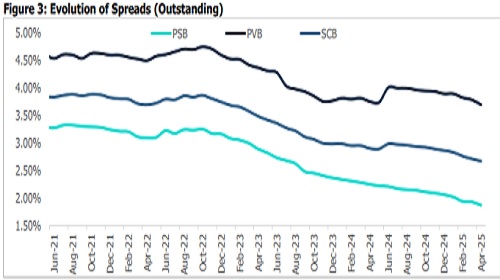

* In April 2025, the spread between the outstanding (o/s) weighted average lending rate (WALR – Lending Rate) and the weighted average domestic term deposit rate (WADTDR – Deposit Rate) for scheduled commercial banks (SCBs) continued to tighten, narrowing by four basis points (bps) on a month-on-month (m-o-m) basis, remaining at a 10-year low of 2.67%.

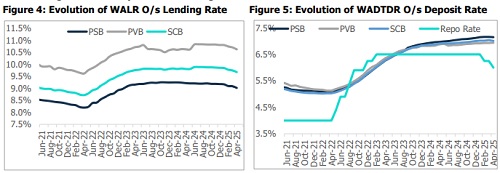

* The SCBs lending rate on o/s rupee loans fell by seven bps m-o-m to 9.68%, driven by rate cuts, competition and reduced share of high-yield assets. The deposit rate on o/s rupee term deposits also decreased by three bps to 7.01%, driven by a 28 bps reduction of foreign banks (FBs). In comparison, PVBs increased their deposit rates by one bps, in contrast to a one bps decrease by PSBs, standing at 6.94% and 7.15% respectively.

* In April 2025, SCBs' fresh spreads diverged from o/s spreads and rose by 26 bps to 2.96%, PVBs by four bps to 3.67%, PSBs by eight bps to 1.73% and FBs by 27 bps to 3.34%, reflecting the impact of rate cuts.

* As of April 2025, lending rates on fresh loans for SCBs fell by 9 bps m-o-m to 9.26%, driven by surplus liquidity and rate cuts. Fresh deposit rates for SCBs also declined by 35 bps m-o-m to 6.30%.

* In May 2025, the one-year median MCLR declined by five bps and stood at 8.95%, as PSBs and FBs declined by five and 31 bps, respectively, reaching 9.03% and 7.62%, while PVBs remained flat at 10.0%.

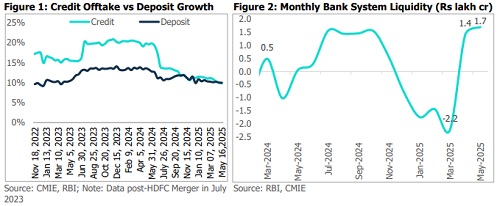

Slower Credit Growth Matches Deposits; Liquidity Stays Surplus

* Credit offtake rose by 9.8% y-o-y for the fortnight ending May 16, 2025, and came in slower than the previous year’s growth of 15.8% (excluding the merger impact). This slowdown can be attributed to a higher base effect, generally slower growth at the start of the fiscal year. Meanwhile, deposits increased by 10.0% y-o-y, reaching Rs 228.9 lakh crore as of May 16, 2025, lower than the 12.7% growth (excluding merger impact) recorded last year.

* According to CareEdge Economics, as of the end of May 2025, the RBI’s liquidity injections have kept the overall banking system liquidity in surplus. Average systemic liquidity has remained in surplus for the past two months, leading to the weighted average call rate hovering below the repo rate for specific periods. Average banking system liquidity surplus stood at Rs 1.7 lakh crore in May 2025, equivalent to 0.7% of NDTL. This is even higher than the Rs 1.4 lakh crore surplus in April 2025. Over the past few months, RBI’s repo auctions, OMO purchases, and dollar swaps have aided liquidity conditions. Surplus liquidity conditions additionally ensure smoother transmission of the policy rates.

O/s Spread Continues to Witness a Decline in April

* As of April 2025, SCBs o/s spread between lending and deposit rates continued to remain at a decadal low, at 2.67%, reflecting a slight m-o-m decrease of four bps. The o/s spread for PSBs and PVBs has also been compressing over the past months, reducing again by six and nine bps, reaching 1.87% and 3.69%.

* As of April 2025, the outstanding lending rates declined m-o-m. SCBs dipped by seven bps to 9.68%, PSBs to 9.02% and PVBs by eight bps to 10.63%. This decline was largely driven by RBI’s repo rate cut to 6.00% and also reflects the reductions in rates in key sectors such as industry (8 bps), housing (20 bps), education and personal loans (19 bps), and trade (11 bps) q-o-q, along with the leading banks to adjust their lending rates. Meanwhile, the outstanding deposit rates of SCBs declined by three bps to 7.01%, which was attributed to policy-driven easing, surplus liquidity, and repricing of deposit portfolios toward lower market rates. PSBs and FBs declined by one and 28 bps, at 7.15% and 5.90%, respectively, while PVBs rose marginally by one bps at 6.94%.

Outstanding Business: Deposit and Lending Rates Decline

Above views are of the author and not of the website kindly read disclaimer