Automobiles Sector Update : PV and 2W demand remains healthy even in November by Motilal Oswal Financial Services Ltd

Demand sustenance from Jan26 onwards to be a key monitorable

* Domestic 2W ICE sales grew by a robust 19.1% YoY in Nov’25, driven by festive order backlogs and normalization of dealer stock levels post the festive season. It is important to highlight the key growth drivers in motorcycles in Nov’25: 100cc: +19%, 125cc: +8%, 150-250cc: +27%, and >250cc: 25%

* On a YTD basis, however, domestic 2W ICE has posted a marginal 2.2% growth YoY, primarily due to weak demand in 1Q.

* On a YTD basis, among the top four players, TVS is the only one to gain a 190bp share to 18.8% in the domestic 2W ICE segment.

* In motorcycles, the >250cc (+23%) and 150-250cc (+4%) segments have posted volume growth YTD, while the remaining segments have reported a decline. Within the 125cc segment, only HMSI delivered growth, while all other players witnessed a dip. In the 100cc segment, overall volumes declined ~3% YoY, with all major players posting a volume decline except HMCL, which inched up 1.1%.

* In scooters, TVSL(+24%) significantly outperformed peers and the industry growth rate of 7.8%.

* The PV segment rose 18.7% YoY in Nov’25, fueled by growth across all segments, including cars. While cars were up 17%, UVs grew 19% YoY

* YTD growth in PVs, however, has been much lower at 3.6%.

* Within UVs, MM (+18%), Kia (+9%), and Toyota (+18%) outperformed peers.

* Our top OEM picks are MSIL, MM, and TVSL.

ICE 2Ws: TVS continues to outperform in 2Ws

* Domestic 2W ICE sales grew 19.1% YoY in Nov’25. However, on a YTD basis, sales showed marginal growth of 2.2%, largely due to the weak offtake in 1Q.

* On a YTD basis, motorcycle volumes were largely flat, mopeds dipped 5.8%, while ICE scooters posted 7.8% growth.

* On a YTD basis, among the top four players, TVS is the only one to gain a 190bp share to 18.8%.

* On the other hand, HMCL and HMSI lost 90bp and 100bp of market share, respectively, on a YTD basis.

Segmental trends: Motorcycles flat but scooters up 8% YTD

Motorcycle segment:

* Domestic motorcycle sales grew 17.5% YoY in Nov’25, while sales have been flat YoY on a YTD basis.

* On a YTD basis, outperformers include RE (+24.6%) and TVS (+10.6%).

* Conversely, volumes for BJAUT/HMCL/HMSI declined 6.3%/2.3%/1.4% YoY.

* As a result, HMCL’s market share dipped 90bp YoY to 42.1%. Additionally, HMSI has dipped 25bp to 19.7%, while BJAUT has declined 100bp to 16% on a YTD basis.

* Meanwhile, TVS gained a 110bp share YoY to 11%, while RE gained a 165bp share to 8.3%.

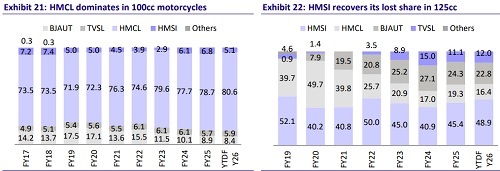

100cc segment:

* The 100cc segment posted a 19% YoY growth in Nov’25; however, sales numbers have declined 3% on a YTD basis.

* It is important to highlight that for Nov’25, HMCL has posted a robust 27% YoY volume growth and has been the key growth driver in the segment. Conversely, BJAUT has posted a 26% YoY decline in volumes in this segment in Nov’25.

* HMSI has been the worst hit, as it lost ~230bp market share to 5.1% on a YTD basis. This was primarily driven by the discontinuation of its Dream series. The Shine 100cc has seen some improvement in demand in the month of Nov’25; however, on a YTD basis, volumes are still down ~15% YoY. The Livo series continues to see a YoY decline, posting a ~32% dip on a YTD basis.

* On the other hand, HMCL has significantly strengthened its position in this segment, having gained ~330bp share to 80.6% on a YTD basis. Its key growth driver has been HF Deluxe, which has posted 4% YoY growth on a YTD basis. However, Splendor volumes have remained flat YoY on a YTD basis.

125cc segment:

* This segment saw an 8.2% YoY growth in Nov’25 and a 4.3% YoY dip for FY26YTD.

* All major players posted a YoY growth in Nov’25 volumes except BJAUT, which dipped ~27% YoY. In fact, HMSI has significantly outperformed industry growth and posted 31% YoY growth.

* Further, on a YTD basis, HMSI was the only player to post YoY growth (+8.1%).

* As a result, HMSI saw a 560bp increase in market share YoY to 48.9% on a YTD basis. HMCL and BJAUT lost 390bp and 220bp, respectively, to end at 16.4% and 22.8% respectively.

* For HMSI, its Shine has grown about 5% YoY on a YTD basis. For November, Shine has outperformed industry growth with 23% YoY growth. Its sales have also been boosted by the launch of the CB 125 Hornet in Aug25 which is currently clocking about 9.4k units per month.

* BJAUT’s CNG bike, Freedom, saw a ~79% decline in YTD sales and is currently averaging at around 1.7k units per month this fiscal.

* For HMCL, the Xtreme 125R witnessed the highest decline of ~33% YoY on a YTD basis. The new Glamour has doubled its monthly sales YoY during Nov’25, indicating an improved customer response. Meanwhile, Splendor volumes declined ~23% YoY on a YTD basis.

* The new TVS Raider has posted a modest 3% YoY growth in November to ~33k units.

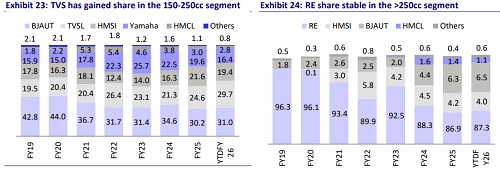

150-250cc segment:

* The 150-250cc segment posted a strong 27.2% growth YoY in Nov’25 but a moderate 4.4% growth on a YTD basis.

* It is important to highlight that for Nov’25, both BJAUT and TVSL posted a robust 45% YoY volume growth in this segment and have been the key growth drivers.

* On a YTD basis, TVS has significantly outperformed peers with 31.4% YoY growth. While Apache has posted a healthy 24% YoY growth in volumes, the TVS Ronin has grown 2.5x on a YTD basis.

* As a result, TVS has gained ~610bp market share to 29.7%.

* BJAUT has been able to maintain its share at 31% on a YTD basis.

* Further, while HMSI has lost 215bp share to 19.4%, Yamaha has lost 380bp share to 16.4%.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Real Estate Sector Update : Ready reckoner catching up with realization growth over past two...