Add HDFC Life Insurance Ltd For Target Rs. 830 By JM Financial Services

With a clouded margin outlook, downgrade to ADD

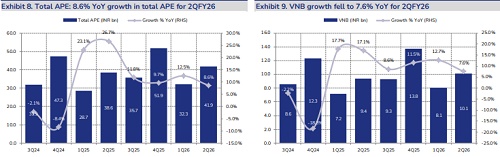

HDFC Life reported weak but in line margins at 24.1% for 2QFY26, as a result of the loss of ITC following GST 2.0 and weak growth of 9% for the quarter, against 12% JMFe. The gross impact on margins was mentioned at 300bps, which the company expects to recoup by 4Q through an improved product mix in favour of protection and non-par/annuity, raising Sum Assured multiples and rider attachment, and an expected pick up in credit life business. We cut our FY26e margins to 24.7%, with an estimated growth of 15% for the year. This translates to a 12% VNB growth for FY26e. As the impact is mitigated, we expect margins to improve to 25.8%/26.8% over FY27/FY28e, resulting in a 20% VNB CAGR with a 16% APE CAGR. While the impact on Mar’27 EV is limited to 1%, we value the stock at 2.4x Mar’27 EVPS (against 2.5x earlier) of INR 347 to get a revised target price of INR 830 (against INR 855 earlier). We downgrade to ADD.

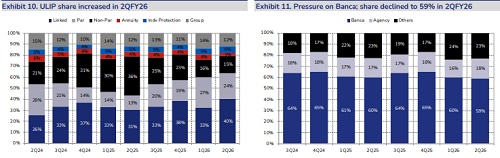

* 2Q APE growth of 9% YoY below 1Q, expect 2H to be better: Agency was the only channel which fired in 2Q with a 22% YoY growth, as a result, APE growth cooled off to 9% from 13% seen in 1Q. In terms of products, while ULIP and par segments grew strongly at 42%/105%, annuity and non-par saw YoY contraction of 53%/29%. 35%/13% growth in individual/group protection supported margins, alongside the positive impact of higher Sum Assured variants and higher rider attachment rates. With lower deposit rates, increasing SIP inflows suggesting people looking back at markets and a weak base of 2HFY25, we expect growth to pick up 18% in 2H, resulting in a growth of 15% for FY26.

* In line margins, but weak commentary implies a cut in estimates: In 1HFY26, the company reported a 60bps decline in margins with weak growth, 50bps impact of GST reforms and a 30bps impact of surrender norms. The company mentioned the gross impact of GST reforms at 300bps. In 2H, we expect growth to pick-up to 18%, a pick-up in credit life with the underlying credit growth and higher product level margins (excluding GST impact) for ULIPs and non-par. Hence, we expect FY26e margins of 24.7%, higher than 1H levels, still 90bps below FY25 margins. With the bleak margin outlook, we expect VNB growth of 12% for FY26e despite a 15% APE growth for the year. As the impact is mitigated, we expect margins to improve to 25.8%/26.8% over FY26/FY27e, resulting in a 20% VNB CAGR with a 16% APE CAGR.

* Valuations and view – cut VNB by 6%/2% for FY26/FY27e, downgrade to ADD: At CMP, the company trades at valuations of 2.5/2.2x FY26/FY27e EVPS, implying 18/16x FY26/FY27e EVOP. While we believe in the company’s ability to recoup the impact over the next 2-3 quarters, the company’s valuation premium in the sector implies limited upside in the near term. While we cut our VNB estimates by 6%/2%/1% for FY26/FY27/FY28e, the impact on Mar’27 EV is limited to 1%. We value the stock at 2.4x Mar’27 EVPS (against 2.5x earlier) of INR 347 to get a revised target price of INR 830 (against INR 855 earlier). We downgrade the stock to ADD.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361