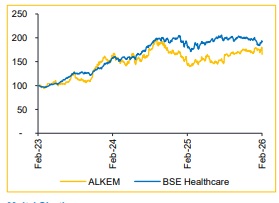

Add Alkem Labs Ltd for the Target Rs.5,995 by Choice Institutional Equity Limited

High-value Launches Propel Operating Leverage

The company has witnessed a recovery in revenue over 9M and we now expect low-teens growth in FY26, to be driven by its two core regions - India and the US. Upcoming high-value launches, such as, Semaglutide, Valsartan and Tolvaptan, are expected to support margin expansion from FY27. For FY26, we factor in EBITDA margin of ~22%, led by an improving mix with a higher contribution from chronic products. We have marginally revised our FY26/27E estimate upwards by 2.0%/3.1%, respectively, and continue to value the stock at 25x earnings, resulting in a revised TP of INR 5,995 (from INR 5,850). In light of the better-than-expected 9M performance in FY26, we upgrade our rating to ADD. We also see additional upside potential from a successful ramp-up of the Medtech and CDMO verticals.

In-line Quarter; Sequential Softness in Margin and PAT

? Revenue grew 10.7% YoY / declined 6.6% QoQ to INR 37,368 Mn (vs. CIE estimate: INR 37,363 Mn).

? EBITDA grew 9.0% YoY / declined 10.1% QoQ to INR 8,280 Mn; margin contracted 35 bps YoY / 86 bps QoQ to 22.2% (vs. CIE estimate: 22.9%).

? Adjusted PAT increased 8.7% YoY / declined 11.1% QoQ to INR 6,802 Mn (vs. CIE estimate: INR 7,099 Mn).

Double-digit Growth Supported by US Scale-up and India GLP-1 Launch

The company delivered healthy growth in Q3 and we expect low-teens revenue growth in FY26, primarily driven by India and the US.

? India: We expect this region to continue outperforming the IPM, supported by strong traction in core brands, the launch of Semaglutide and recovery in trade generics. An improving product mix with a higher share of chronic therapies should further support growth and margin stability.

? US: We forecast high-teens’ growth in FY26, driven by new launches including biosimilars, alongside steady expansion of the base portfolio. In addition, the US CDMO facility and Medtech vertical are strategically positioned as high-margin, long-term value-accretive growth drivers.

Product Mix to Drive Sustained Margin Expansion

While Q4 is typically a seasonally weak quarter, we expect FY26 EBITDA margin to sustain at ~22% (in line with 9MFY26 level), implying a ~250 bps expansion over FY25. This improvement is likely to be driven by a favourable product mix and continued scale-up in India revenue. We anticipate a further 50–100 bps annual margin expansion from FY27, supported by the ramp-up of new launches and improving contribution from the Medtech and CDMO segments

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131