Accumulate Bajaj Finance Ltd For Target Rs.1,125 by Prabhudas Liladhar Capital Ltd

LRS 2026-30: Betting big on FINAI

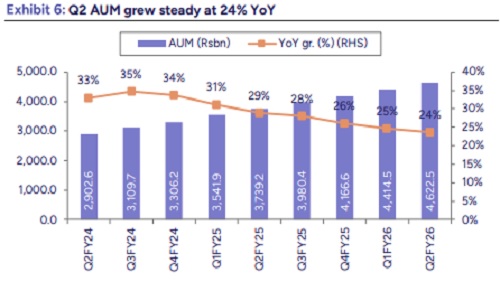

BAF outlined its long-term strategic framework (LRS 2026-30). Key themes revolved around customer centricity, AI adoption and risk management. Company aims to grow disbursements 10x by launching new products and leverage technology as a catalyst to drive growth (100 mn loans/ 3.5- 4.5 bn web visitors/ 160-180 mn app downloads) and reduce operating cost (Opex to NIM ratio of 31% by FY30). It expects to maintain a resilient asset quality profile with GNPA/ NNPA below 1.2%/ 0.4% over the long-term. While BAF has lowered its FY26 growth guidance to ~23%, it is seeing strong traction in new verticals (Cars, Gold, MFI) and new customer addition. We expect AUM growth of 24%/ 23% in FY27E/ FY28E led by new product lines and higher cross-sell. We expect BAF to deliver an RoA/ RoE of 4.4%/ 21.4% by FY28E. Upgrade to ACCUMULATE with a TP of Rs 1,125 (4.6x Sep-27 P/ABV vs. 4.2x earlier) on improved long-term growth outlook and cost profile. Elevated credit cost remains a near-term drag.

* Moving to a customer-centric model: Company aims to transition from a product-centric approach to a customer-centric model by focusing on experience, long-term relationships and products/ processes designed for customer satisfaction. It is planning to launch a wealth management business and increase Product Per Customer (PPC) to 7.5 products vs. ~6 products currently. By launching new products and offering all these products to all customers across all channels (Web, App, Social, POS and call-center), it expects to grow disbursements by 10x- from Rs 8bn per month to Rs 80bn.

* To be a technology leader in financial services: BAF continues to leverage technology as a catalyst to drive innovation, anticipate trends and re-shape business models. It has identified two main strategies for this goal- (1) Data for AI (organize structured and unstructured data) (2) Consumer AI to transform customer experience (a dedicated new consumer AI platform). With these initiatives, it expects to (1) reach 100 mn loans (2) increase net users (3.5- 4.5 bn web visitors/ 160-180 mn app downloads) (3) boost digital contribution to 30% (4) cut service requests and queries by 90% with an improved cost profile- 31% Opex to NIM by FY30 (vs. 34.7% in FY25).

* Aim to be the lowest risk company in India: Company reiterated low tolerance across all dimensions of risk- credit risk, operational risk, fraud risk, compliance risk, market risk, technology risk and reputation risk while maintaining sustainable growth and profitability. With greater resilience and scalability, it expects to keep GNPA/ NNPA controlled below 1.2%/ 0.4%.

* Our view and valuation: While BAF has lowered its FY26 growth guidance to ~23% due to slower growth in the MSME and mortgage portfolio, it is seeing strong traction in new verticals (Cars, Gold, MFI) and is on track to add 17 mn new customers in FY26. Post FY26E, we expect AUM growth of 24%/ 23% in FY27E/ FY28E led by new product lines, new users (via web/ app downloads) and higher product penetration per customer (PPC of ~7.5). We tweak our opex estimates for FY27/ FY28E as investments in AI, technology and customer innovation are likely to pay off over the long-term. We expect BAF to deliver an RoA/ RoE of 4.4%/ 21.4% by FY28E.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271