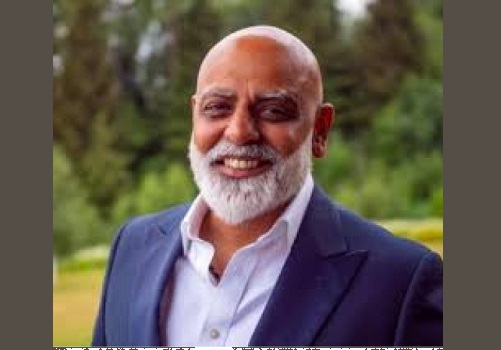

Weekly Oulook : Weekly Outlook Gold / Silver / Crude Oil / Copper / USDINR / NCDEX GUARSEED By Anuj Gupta, IIFL Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Views on Weekly Oulook - Weekly Outlook Gold / Silver / Crudeoil / Copper / USDINR / Turmeric By Mr. Anuj Gupta, Vice President, IIFL Securities

As expected, last week MCX Gold prices increased from the lower levels and closed 0.71% high at 56130 levels. In the international market it increased by 0.60% and closed at $1867 levels. But on the other side MCX silver prices corrected sharply by 2.42% and closed at 62851 levels. In the international market it corrected sharply by 3.44% and closed at $20.52 levels.

We have observed that on the last trading day of the week gold and silver prices recovered from the lower levels as US labour data showing slower wage growth has eased the US inflation concern and hence market is expecting modest US Fed rate hike. Gold prices corrected recently due to rise in US dollar rates. But, after the release of US labour data showing slower wage growth eased the US inflation concerns as market is now rife with speculation that the US Fed officials may adopt a modest rate hike approach in upcoming FOMC meeting scheduled this month. This modest US Fed rate hike speculation triggered selling pressure in the US dollar that resulted in retracement in Dollar Index from its 3-month highs.

Technically the trend of gold and silver is sideways to up. Gold has immediate support placed at $1,835 per ounce levels and then $1820 per ounce levels while on the upper side it is facing hurdles at $1,890 per ounce levels and then $1920 per ounce levels.. On MCX, they said that gold price has immediate support placed at ?55,700 and then 55,200 levels whereas it is facing resistance at ?56,700 and ?57,200 per 10 gm levels. Silver has immediate support at 61000 levels and then 58000 levels while on the upper side it is facing hurdles at 64000 levels and the 66000 levels. Yellow metals may also take positive cues from the news of bankruptcy of Silver Valley Bank is expected to put equity assets under and hence safe haven demand may support the bullions.

Crude Oil

Last week MCX Crude oil prices corrected by sharply 3.20% and closed at 6,292 levels. Brent Crude oil corrected by 3.94% and closed at $82.36 per barrel. on the last trading day of the week it increased by 1% after better-than-expected U.S. employment data, though both benchmarks fell more than 3% on the week on U.S. interest rate hike jitters. On the supply side, major oil producers Saudi Arabia and Iran, both members of the Organization of the Petroleum Exporting Countries, re-established ties after days of previously undisclosed talks in Beijing. U.S. oil rigs fell by 2 to 590 this week, their lowest since June, according to data from Baker Hughes.

Technically, the trend of crude oil is range bound between $80 to $85 levels. On MCX it has immediate support at 6000 levels and thn 5800 levels while resistance at 6400 levels and then 6700 levels. We are expecting that prices may retreat from the lower levels and may trade with positive bias.

Technically, Natural gas has immediate support at 190 levels and then 175 levels, while resistance at 220 levels and then 230 levels. If it trades above 220 levels then it may trade towards 230 levels.

Copper

Last week we saw weak closing on the base metals. MCX Copper down by 0.77% and closed at 751.50 levels. Zinc prices corrected by 3.07% and closed at 260.15 levels. Lead prices corrected by 0.60% and closed at 182.10 levels. Aluminium prices corrected 2.49% and closed at 204 levels. Lower Chinese demand put pressure on the base metals. China's unwrought copper imports in the first two months of 2023 fell 9.3% from a year earlier, as higher global prices curbed buying appetite. Arrivals of unwrought copper and products into China, the world's biggest consumer of the red metal, were 879,000 tonnes in January and February, down from 969,289 tonnes in the same period a year earlier.

For the next week we are expecting that copper prices may trade sideways between support and resistance levels. Technically it has immediate support at 740 levels and then 730 levels while resistance at 762 levels and 775 levels. We are recommending buying on support levels.

USDINR

Last week Rupee against dollar depreciated by 0.14% and closed at 82.02 levels. Strength in the dollar was negative for the rupee. Correction in the Indian equity market was one of the reasons for the correction in the Indian rupee. India's foreign exchange reserves rose by $1.5 billion in the week ending March 3, breaking a four-week falling trend. The reserves were at $562.4 billion, Reserve Bank of India data showed. RBI data showed that within total reserves, foreign currency assets rose $1.181 billion to $497.087 billion. Reserves held in gold rose $282 million to $42.033 billion.

For the next we are expecting we can see strength in rupee as the dollar may correct due to weak US Non farm payroll data. FOMC may use lower hawkish instances in upcoming FOMC meetings. Technically rupee has an immediate support at 81.60 levels and then 81 levels while resistance at 82.50 levels and then 83 levels.

NCDEX GuarSeed

Last week NCDEX Guarseed increased from the lower levels and closed by 2.51% higher at 5683 levels. Pre monsoon showers have been witnessed in a few areas of Rajasthan, Punjab, Gujarat due to early heat waves. The change in the climate situation as early heat waves hit northern India. Fear of crop damage and the fear of el nino and below normal rain may support agri commodities prices.

For the next week we are expecting a positive trend may be seen in the NCDEX Guarseed and Guar Gum prices. Guarseed has immediate support at 5500 levels and then 5300 levels while resistance at 5900 and then 6100 levels.

Above views are of the author and not of the website kindly read disclaimer

More News

Weekly Outlook -Gold, Silver, Crude Oil, Copper ,USDINR & NCDEX Guarseed By Mr. Anuj Gupta, ...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">