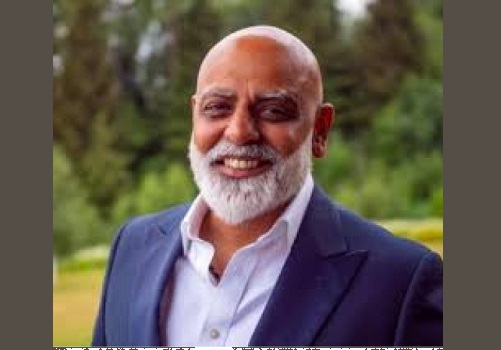

Perspective on Gold and Currency price reaction by Mr Nish Bhatt, Founder & CEO, Millwood Kane International

Below the Perspective on Gold and Currency price reaction by Mr Nish Bhatt, Founder & CEO, Millwood Kane International

The US Fed cut rates by 25 bps per the street expectation. What the market was not expecting was the hawkish Fed commentary. The Fed has now indicated only 2 rate cuts instead of 3-4 earlier. The US Fed also hiked its inflation expectations from 2.5% to 2.1% earlier. The Fed may take over 1-2 years to get inflation under check. This development led to a fall in the US markets, over 2.7-2.9%. The US Dollar rallied to an over 2-year high.

A rally in the USD affects most things. The INR has slipped to an all-time low and breached the crucial mark of 85. A stronger dollar has put pressure on gold, too. The yellow metal has corrected over 1% each in the international and domestic markets.

A stronger dollar increases demand and has historically led to outflows of USD from the EMs, thereby affecting

equity markets. The Indian rupee is on a downward slide. It has depreciated over 100 paise in just over 5 weeks against the USD. Moving forward, we expect volatility to continue, major cues will be the new administration in the US, and the announcement on trade tariffs. We expect gold prices to be on a strong footing given the geopolitical situation across markets, INR however will see some weakness in the short to medium term.

Above views are of the author and not of the website kindly read disclaimer

More News

Perspective on Indian Rupee, U.S. dollar, EUR/USD, British Pound, Gold, Silver, Copper, Crud...