Update On Dabur India Ltd By HDFC Securities

Our Take:

Founded in 1884 in Bengal by Dr. SK Burman to mass produce and dispense Ayurvedic medicines for diseases such as cholera, malaria and plague, Dabur India Ltd. (Dabur), the world’s largest Ayurvedic and natural healthcare company, has come full circle in the pandemic year of 2020-21. Turning opportunity into crisis, Dabur came out firing on all cylinders, bolstering its time tested Ayurveda portfolio by introducing a slew of products in formats as varied as powders to capsules. Over the past few years, Ayurveda has gained currency with the new-age consumers seeking traditional remedies for their health and personal care needs.

The demand for Ayurvedic Healthcare products, particularly in preventive healthcare and immunity building witnessed a surge in the wake of the Covid-19 pandemic. While many companies have joined the immunity bandwagon, Dabur, with its 136-year-old heritage, traditional herbal positioning, and strong R&D, claims the ‘right to win’ here. Besides healthcare, Dabur has strong positioning in various categories including fruit juices (#1), oral care and hair care (#2), all of which have natural/Ayurveda at its heart.

Dabur is a unique play on fast-growing Ayurveda sector. Dabur’s positioning as world leader in Ayurveda/Herbal products, renowned portfolio of brands, demonstrated ability to create new categories and sub-categories further backed by superior distribution network makes it well placed to capture lifestyle changes-led growth in the consumer goods space, while giving it an edge over competitors.

Valuation & Recommendation:

Covid-19 has turned out to be an inflection point for Ayurveda and in turn for Dabur who after subdued performance over FY16-20 due to macroeconomic headwinds reported solid 14.6% YoY growth (FY21) in domestic FMCG sales led by stellar 31.9% YoY growth in healthcare driven by 42.5%/30.6% YoY growth in health supplements/OTC & Ethicals. Dabur has always been admired due to its wide product range and strong rural play (45% rev mix). However, the company was performing below its potential leading to FY21.

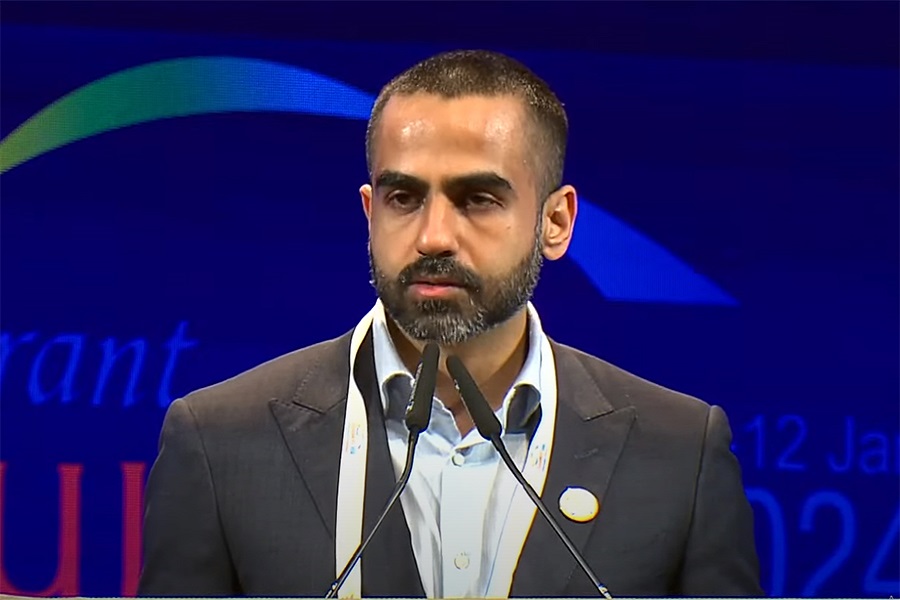

Extensive product range was limiting management’s focus (defensive approach due to focus on many brands). Rural play (acceleration) was looking more of a hope than a reality (given disruptions; demonentisation, GST, consecutive droughts). What helped Dabur during the pandemic, we believe, was its CEO Mr. Mohit Malhotra, who had taken charge just a year before in Jan 2019.

Post Mr. Malhotra’s appointment, Dabur’s strategy has turned aggressive (outperform market) vs. defensive (riding with the tide). He channelized focus on 9 ‘Power Brands’ (~70% rev mix) to be supported by concentrated media spends and reformulated Dabur’s strategies; (1) Scaling power brands, (2) Driving innovation and renovation for market leadership, (3) Distribution expansion, (4) Operational excellence and (5) Capability.

Riding on Covid-19 tailwinds, Dabur’s health supplements (majorly Chyawanprash & Ethicals) reported 42.5% YoY growth in FY21. While the growth may moderate going ahead, prospects here remain robust given the penetration of health supplements in India is mere ~10% (vs 80% in developed countries). Also protracted pandemic will mean that people will form new habits for preventive health products boosting the overall heathcare portfolio.

Beyond healthcare too, the company gained market share across key categories including oral care, personal care and packaged juices and nectars, even as it decided to ramp up its food offerings with the Hommade brand. With gradual lifting of travel restrictions, company’s other discretionary segments (home care, personal care & beverages) should witness strong recovery. International business (26.4% of sales) which has been laggard for long time is expected to post double digit growth over next 3-5 years aided by relevant strategic initiatives. We expect EPS growth of ~13% CAGR over FY21-24E on the back of 11.4% CAGR growth in sales over FY21-24E.

While Dabur’s performance over FY16- 20 was on the lower end amongst its FMCG peer group, we expect it to significantly outperform its peers over next 3-5 years, FY21, if anything was the path-breaking year it needed. We think the base case fair value of the stock is Rs 670 (51.5x Sept’23E EPS) and the bull case fair value of is Rs 716 (55x Sept’23E E EPS). Investors can buy the stock in the Rs 613-619 band (47x Sept’23E EPS) and add more on dips to Rs 557-563 band (43x Sept’23E EPS). At LTP of Rs 616, it quotes at 47.4x Sept’23E EPS.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Above views are of the author and not of the website kindly read disclaimer