Neutral Aavas Financiers Ltd for the Target Rs. 2,050 by Axis Securities Ltd

A mixed quarter with usual business jump but less-than-usual asset quality pull-back

The sequential disbursement jump for Aavas was on traditional lines and hence the annual growth in originations was 7%/10% for Q4/FY25. Growth in new business continues to be led by MSME loans (share rising in AUM) while the growth in HL disbursements was moderate at 2% yoy/7% yoy in Q4/FY25 (incremental ATS has grown by 6-7% yoy). The login-to-sanction ratio in HL has come-off due to underwriting caution exercised in certain markets/locations where unsecured/MFI delinquencies rose significantly. As generally seen, there was a marginal increase in portfolio run-off in Q4 FY25, though BT out was mentioned to be within the normal trend of below 6%. AUM growth decelerated to 18% yoy during the year from 22% in FY24.

Portfolio spread got pruned by 5 bps on sequential basis, solely driven by decline in portfolio yield as CoF was stable. The 5 bps dip in contracted portfolio yield, notwithstanding the underlying favorable composition shift, was due to lower origination yield and repricing of BT requests. Due to tight liquidity conditions, the incremental borrowing cost was elevated in the quarter (8.47% v/s 8.24% being the cost of stock). While in percentage terms there is 46 bps and 6 bps improvement in 1+ dpd and GNPL respectively, the absolute sequential pull-back in Stage-2 and Stage-3 assets was missing (usually seen in a fourth quarter). Nonetheless, the credit cost was moderate at 15 bps and there were marginal improvements in ECL coverage of Stage2 and Stage-3 assets.

Commentary of 18-20% growth and moderate credit cost; portfolio spread expected to recover in H2 FY26

Management aspires to deliver 15-20% disbursement growth with addition of significant branches in Q4 FY25 and through FY26 and the expected normalization of login-to-sanction ratio. Incremental business yield improved by 22-23 bps in FY25 aided by product mix shift and a more refined risk-based pricing through BRE. Aavas expects further improvement in the origination yield over coming quarters (until the need arises to pass-on any CoF decline). BT pressure may increase in the future as rate down cycle goes deep. CoF in near term could remain sticky with a gradual decline in incremental CoF and some lag in pass-on of the benefits from repo rate cuts. In the medium-to-longer term, Management expects portfolio spread to move back to 5%+. Credit cost has been guided to be within 25 bps in FY26 versus the trend of 15 bps in past two fiscals.

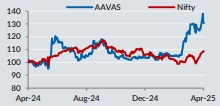

Well-priced for 18-20% growth and 15% RoE; move rating to Neutral

We estimate Aavas to deliver 18-19% CAGR in loan book and avg. RoE of ~15% over FY25-27. In our view, the portfolio spread for FY26 could be similar to FY25 and would likely recover in FY27. Besides the movements in spreads and disbursements, a key monitorable would be asset quality due to some challenges in collections/recoveries in certain locations. Stock trades at 20.5x P/E on FY27 estimates, which is the highest valuation in our affordable housing coverage. We believe that current valuation doesn’t offer much room for rerating, considering the current growth and RoE expectations. Move rating on Aavas from Add to Neutral.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633