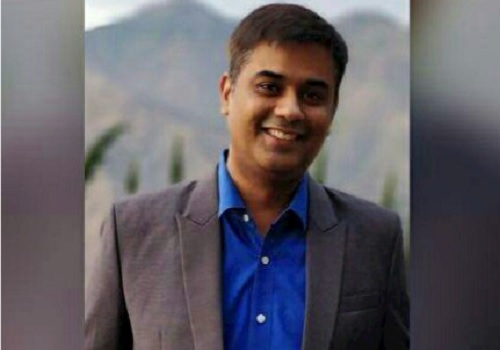

54th GST Council meeting - Expectation Input Insurance Sector by Sandeep Pareek, Partner, Indirect Tax, BDO India

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below the 54th GST Council meeting - Expectation Input Insurance Sector by Sandeep Pareek, Partner, Indirect Tax, BDO India

Perspective - Will the GST council remove GST on term insurance in its upcoming meeting?

Multiple stakeholders, including sitting ministers, have requested for exempting GST on term insurance as well as health insurance. It is likely that the GST Council may favourably consider this demand of the industry, especially if the revenue loss, due to grant of such exemption, is not major. However, to allow the full effect of exemption from GST to be passed on to the public at large, the insurance companies would also need to be allowed full input tax credit, without requiring a reversal of credit due to exemption from GST on term insurance.

Perspective - Why should GST on insurance be removed from insurance products?

One of the main reasons for exempting GST from term insurance products is to promote the term insurance plans, by making them more affordable to the masses.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Vakrangee trades higher on the BSE

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">