2-wheeler finance segment for NBFCs to witness growth of 18-19% in FY26: CareEdge Ratings

According to CareEdge Ratings, while 2W sales growth is expected to slightly moderate, NBFCs 2W AUM is expected to grow at 18-19% in FY26 driven by higher cost of vehicle ownership. As per CareEdge Ratings’ estimates, the average loan amount in the 2W segment has seen a notable rise—from ?86,111 in FY21 to ?1,14,929 in FY25. This upward trend is attributed to inflation-driven raw material cost hikes, increased vehicle ownership expenses following the implementation of OBD-II Phase-B norms [1], and a rising consumer inclination toward higher cubic capacity two-wheelers, indicating a shift toward premiumisation.

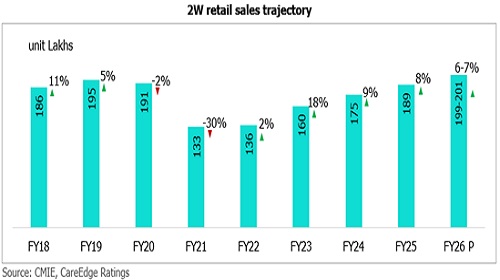

CareEdge Ratings anticipates that the 2W retail domestic industry is expected to report a sales growth of approximately 6-7% in FY26. While the high base of FY25 and the rollout of OBD-II Phase-B emission norms may temper the pace slightly, the overall sectoral outlook remains strong post GST cuts in September 2025.

It expects NBFCs a to continue their cautious stance with more focus on selective underwriting of better-quality customers. CareEdge Ratings estimates the credit costs for 2W portfolio in FY26 to remain in the range of 3.9% to 4.1%.

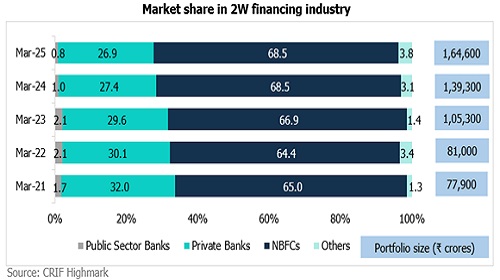

Two-wheeler (2W) retail sales grew at a 10% CAGR over three years between FY21 to FY24. However, the growth slowed to 8% in FY25 led by a high base effect, weak rural sentiments and cautious lending by NBFCs. Overall, NBFCs dominate the 2W finance market with a 68.5% share in FY25, driven by targeted segmentation of untapped, higher-yield borrowers and captive NBFCs leveraging synergies with parent companies.

According to Sanjay Agarwal, Senior Director – BFSI, CareEdge Ratings said, “We expect FY26 growth to remain similar to FY25 levels of 18-19%, reflecting a measured approach by financiers. The NBFC 2W finance portfolio grew at a 22% CAGR over four years between FY21 to FY25, reaching ?1,12,751 crores by March 31, 2025. Growth moderated to 18% in FY25 owing to financiers adopting cautious approach in the wake of general rise in asset quality stress.”

The 2W financing market has grown at a CAGR of 16% since 2021; touching Rs.1.64 lakh crore as on March 31, 2025. NBFCs have continued to dominate the 2W financing market while both public and private sector banks have seen a decline in their share.

NBFCs cater to this segment by serving underbanked markets through faster underwriting and disbursement. Despite 2W loans being secured, customers usually provide minimal documentation and are often new to credit. Their targeted segmentation allows NBFCs to serve this higher-risk group effectively. On the other side, captive NBFCs, which account for ~20% of the market share in disbursements, benefit from easier customer access through their parent companies.

Looking ahead, CareEdge Ratings anticipates that NBFCs will continue to lead the 2W financing market as the banks remain focussed on relatively less risky asset classes.

Domestic 2W Market: Retail sales growth to witness some moderation during FY26, with growth expected to pick-up in H2

The domestic 2W sales experienced strong expansion over the last four years, recording a compound annual growth rate (CAGR) of 9% between FY21 to FY25, primarily driven by strong domestic demand during FY23 and FY24. Key tailwinds to this growth have been pent-up replacement demand post covid-19, availability of newer models and higher disposable income and affordability, with better access to finance. Besides, a shift in consumer preference towards electric scooters and executive motorcycles has also reshaped the market. However, retail sales growth normalized to 8% in FY25 led by high base effect, weak rural sentiments and cautious lending by NBFCs owing to borrower over-leveraging.

During Q1FY26, the 2W industry registered sales of 48 lakhs units, up 5% on a YoY basis. The lower sales volumes witnessed during Q1 is broadly a seasonal phenomenon whereby the 2W sales generally pick up during the onset of the festive season in H2. Looking ahead, CareEdge Ratings anticipates the FY26 sales growth to be in the 6-7% range driven by expectation of improved rural incomes on the back of above-normal monsoon and higher sales in H2 post GST cut from 28% to 18% on September 22, 2025 for 2W with engine capacity up to 350 cc.

Within motorcycles, while sales volume of entry-level motorcycles grew by only 8% y-o-y in FY25 (PY: 6%), executive and premium motorcycle volumes grew by 12% (PY: 14%) and 10% (PY: 16%) respectively. This shift coupled with rising cost of ownership together has pushed up the average ticket size of 2W disbursements for financiers. As a result, disbursements having ticket size in the range of Rs.1-1.5 lakhs have witnessed sharpest rise over last few years.

Additionally, share of 2W priced above Rs1,50,000 in total disbursements rose from 6% in FY21 to 15% in FY25, supported by increased discretionary income of consumers.

CareEdge Ratings expects 2W sales volumes to grow by 6-7% in FY26 following the improved affordability post GST cut from 28% to 18% for 2W with engine capacity upto 350 cc and better rural incomes as a result of above-normal monsoon.

Above views are of the author and not of the website kindly read disclaimer