Spot Gold is likely to trade with negative bias amid firm dollar and rise in US treasury yields - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with negative bias amid firm dollar and rise in US treasury yields. Further, demand for safe haven may decline amid ease in geopolitical tension. Iran and US have reached an understanding on the main guiding principles of their nuclear talks and negotiators from Russia and Ukraine concluded the first of two days of peace talks in Geneva. Furthermore, recent batch of economic data from US painted mixed picture for Federal Reserve interest rate cut, as US job data signaled stabilizing labor market while, CPI data showed inflation increased less than expected. Additionally, investors will remain cautious ahead of Fed’s meeting minutes, advance estimate of US GDP, and PCE inflation data for more guidance on the policy outlook

* MCX Gold April is expected to slip towards Rs.149,000-Rs.147,000 level as long as it stays below Rs.154,000 level.

* MCX Silver March is expected to slip towards Rs.222,000-Rs.220,000 level as long as it stays below Rs.242,000 level.

Base Metal Outlook

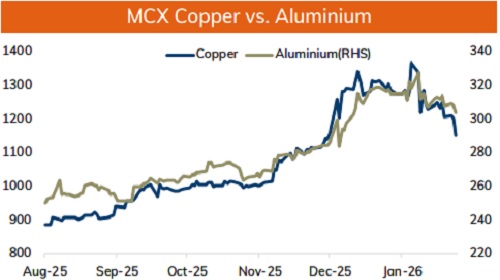

* Copper prices are expected to trade with negative bias amid firm dollar and signs of weak demand in China amid Lunar New Year holidays. Additionally, persistent rise in inventories at LME registered warehouses would hurt prices. Furthermore, Yangshan copper premium, which reflects Chinese appetite for imported copper, was at $33 a ton, still too low to indicate strong demand. Additionally, investors will remain cautious ahead of slew of economic data from durable goods orders to housing data from US to gauge economic health of the country and demand outlook

* MCX Copper Feb is expected to slip towards Rs.1130 level as long as it stays below Rs.1185 level. A break below Rs.1130 level prices may be pushed towards Rs.1225-Rs.1120 level

* MCX Aluminum Feb is expected to slip towards Rs.298 level as long as its stays below Rs.308 level. MCX Zinc Feb is likely to face stiff resistance near Rs.322 level and slip further towards Rs.315 level

Energy Outlook

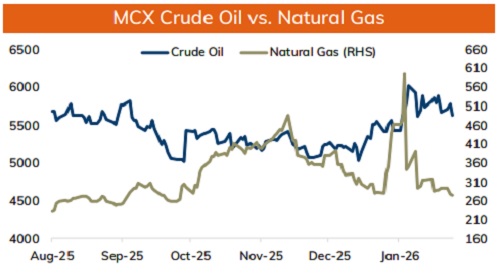

• NYMEX Crude oil is likely to trade with negative bias amid firm dollar and prospect of rising supply as OPEC+ is leaning towards a resumption in production increases. Moreover, geopolitical risk premium may reduce as talks between US and Iran progressed, raising hopes of de-escalation of tensions between the two countries. Any meaningful breakthrough would potentially boost oil supply from Iran. Additionally, all eyes will be on peace talks between Russia and Ukraine, any resolution could see lifting of sanctions on Russia, bringing back more oil into the market. Furthermore, reports of gradual increase in oil production at Kazakhstan's giant Tengiz oil field would weigh on oil prices

• MCX Crude oil March is likely to slip towards Rs.5540-Rs.5480 level as long as it stays below Rs.5830 level.

• MCX Natural gas March is expected to slip towards Rs.260-Rs.254 level as long as it stays below Rs.285 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

.jpg)

.jpg)