MCX Silver Dec is expected to face hurdle near Rs.152,400 level and correct towards Rs.146,000 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to face hurdle near $4180 and move back towards $4050 amid easing US-China trade tension and strong dollar. Growing prospects of a trade deal between US and China ahead of next week’s meeting between US president Donald Trump and Chinese President Xi Jinping would ease safe haven demand. Additionally, expectation of rise in US inflation numbers could also restrict its upside. US CPI YoY is expected to cross the 3% mark amid higher tariffs. A higher inflation number could force the US Fed to turn hawkish. Meanwhile, geopolitical tension would bring a sigh of relief to the bullion prices.

* Spot gold is likely to face hurdle near $4180 and move lower towards $4050. Only a move above $4180 it would turn bullish again. MCX Gold December is expected to face resistance at Rs.125,500 level and move back towards Rs.122,000 level.

* MCX Silver Dec is expected to face hurdle near Rs.152,400 level and correct towards Rs.146,000 level.

Base Metal Outlook

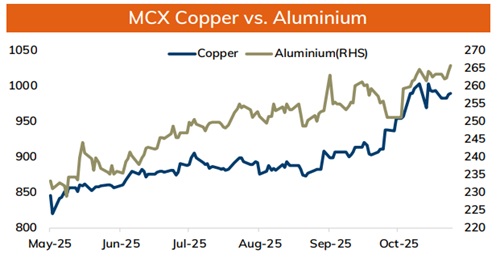

* Copper prices are expected to hold its ground and move higher amid easing US-China trade tensions and supply concerns. Disruption in major mines could hurt global supplies and support the red metal to trade higher. A mine in Dominican Republic has been partially closed as around 80 miners were trapped. Meanwhile, investors will eye on next week’s meeting between US president and Chinese President Xi Jinping to get further clarity. Additionally, depleting inventory levels in LME and expectation of fresh round of stimulus from China would support the bullishness in the metal.

* MCX Copper Oct is expected to hold support near Rs.980 and move back towards Rs.1005 level.

* MCX Aluminum Oct is expected to rise towards Rs.268 level as long as it stays above Rs.262 level.

* MCX Zinc Oct looks to rise towards Rs.305 as long as it holds key support at Rs.296. Depleting inventory levels in LME would likely to support prices.

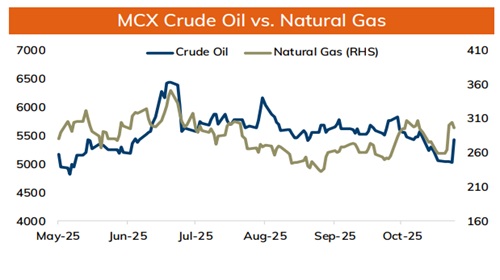

Energy Outlook

* NYMEX Crude oil expected to hold support near $60 per barrel and move higher towards $62 per barrel mark amid supply fears. US sanctions on Russia’s top oil firms would hurt almost one third of oil flows from Russia. Additionally, EU also approves a 19th package of sanction on Russia over its war in Ukraine. This sanction could hurt global oil supplies and support oil prices to trade higher. Meanwhile, gains in prices could be restricted on higher OPEC supplies and easing middle East tension.

* MCX Crude oil November is likely to hold the support near Rs.5260 and move towards Rs.5480. A strong put base near $60 indicates NYMEX crude to hold support.

* NYMEX Natural Gas is expected to move lower amid higher inventory levels. MCX Natural gas Oct is expected to move towards Rs.290 as long as it stay under Rs.308 level. Only a move below Rs.290 it would turn weaker towards Rs.285.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631